Payback Period Excel Template

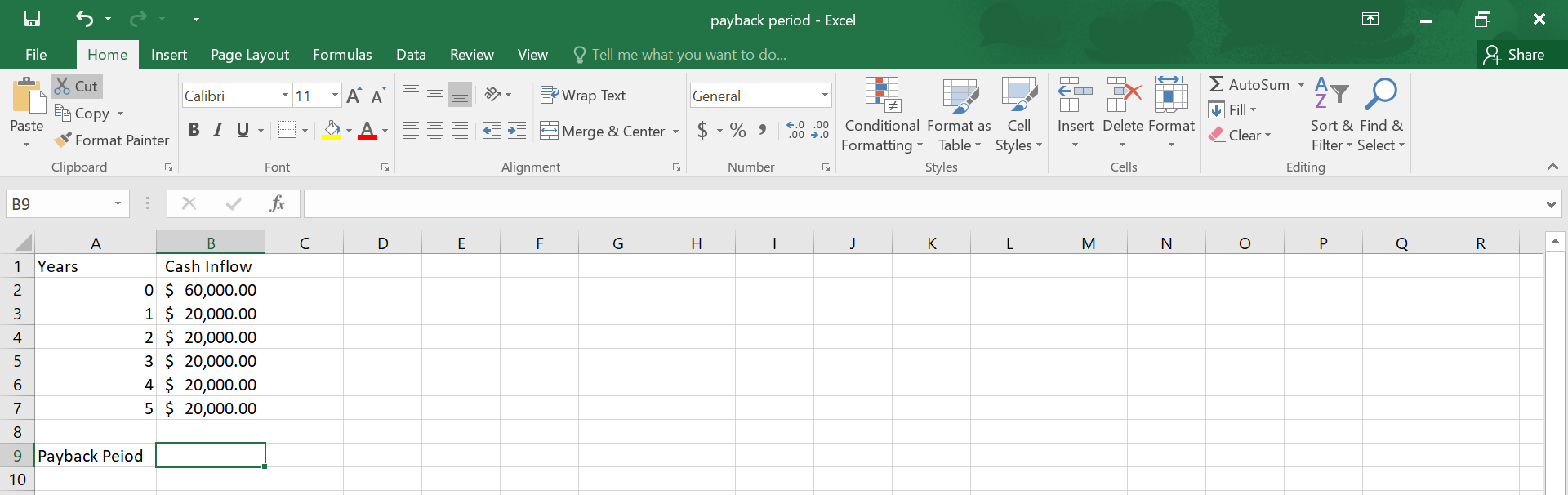

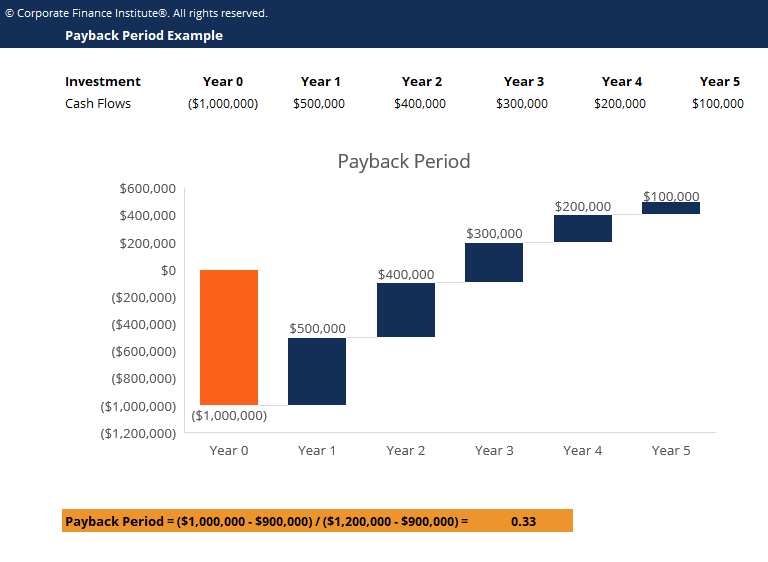

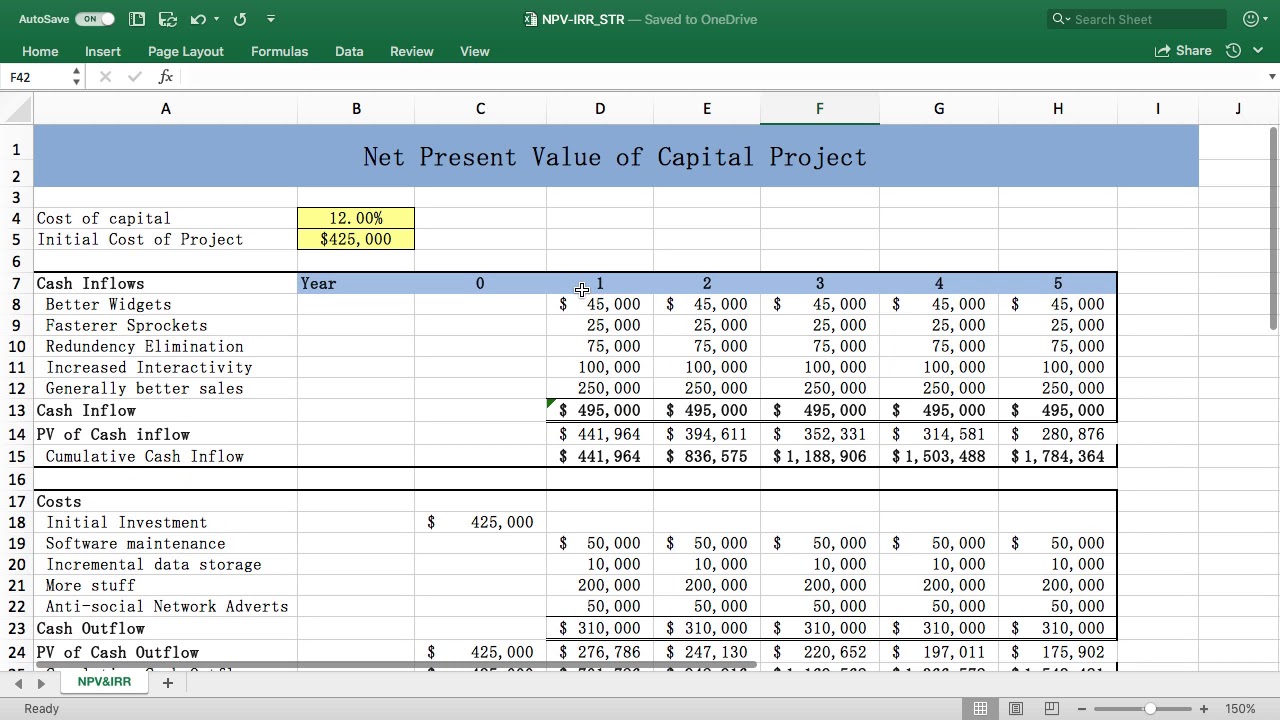

Payback Period Excel Template - Web how to build a payback period calculation template in excel using excel functions to calculate payback period. Web the payback period is the time required in order that investment can repay its original costs in form of cash flow, profits or savings. Web steps to calculate payback period in excel. Without any further ado, let’s get started with calculating the payback period in excel. This excel file will allow to calculate the net present value,. Web this free template can calculate payback period calculator in excel, which will be used for making decisions. Web description what is payback period? Web so, you calculate the payback period in excel by using the following steps: To find exactly when payback occurs, the following formula can be used: Payback period = 4 years; Payback period = 1 million /2.5 lakh; Web pp = initial investment / cash flow for example, if you invested $10,000 in a business that gives you $2,000 per year,. Web a payback period is the time it takes for the cash flow generated by an investment to match or exceed its initial. The payback period helps to determine the. The payback period helps to determine the length of time required to. Without any further ado, let’s get started with calculating the payback period in excel. To find exactly when payback occurs, the following formula can be used: Payback period = 4 years; So, you can use the. The payback period is the length of time required to recover the cost of an investment. Without any further ado, let’s get started with calculating the payback period in excel. Web katrina munichiello what is a payback period? Web types of payback period. So, you can use the. To find exactly when payback occurs, the following formula can be used: Web description what is payback period? Web $400k ÷ $200k = 2 years Web a payback period is the time it takes for the cash flow generated by an investment to match or exceed its initial. The payback period is the amount of time (usually measured in years). Web types of payback period. Аdd a column with the cumulative cash. Web the payback period is the time required in order that investment can repay its original costs in form of cash flow, profits or savings. Web payback period = initial investment or original cost of the asset / cash inflows. So, you can use the. Web feasibility metrics (npv, irr and payback period) excel template. Web general overview the template is constructed to evaluate potential major projects or investments that would require capital budgeting. The payback period is a measure organizations use to determine the time needed to recover the initial investment in a business project. Web types of payback period. To find exactly when. Web steps to calculate payback period in excel. Web a payback period is the time it takes for the cash flow generated by an investment to match or exceed its initial. Web types of payback period. Web general overview the template is constructed to evaluate potential major projects or investments that would require capital budgeting. To find exactly when payback. Web general overview the template is constructed to evaluate potential major projects or investments that would require capital budgeting. Web $400k ÷ $200k = 2 years The payback period helps to determine the length of time required to. Web katrina munichiello what is a payback period? Payback period = 1 million /2.5 lakh; Web steps to calculate payback period in excel. Payback period = 4 years; So, you can use the. Web feasibility metrics (npv, irr and payback period) excel template. The payback period is a measure organizations use to determine the time needed to recover the initial investment in a business project. Web $400k ÷ $200k = 2 years Payback period = 1 million /2.5 lakh; Web so by adding index(f19:m19,,countif(f17:m17,”<0″)+1) and countif(f17:m17,”<0″), you get a. Аdd a column with the cumulative cash. The payback period helps to determine the length of time required to. Web payback period formula. Web so by adding index(f19:m19,,countif(f17:m17,”<0″)+1) and countif(f17:m17,”<0″), you get a. Payback period = 4 years; Web how to build a payback period calculation template in excel using excel functions to calculate payback period. Without any further ado, let’s get started with calculating the payback period in excel. Web katrina munichiello what is a payback period? Web so, you calculate the payback period in excel by using the following steps: Аdd a column with the cumulative cash. The payback period is the amount of time (usually measured in years) it. Web the payback period is the time required in order that investment can repay its original costs in form of cash flow, profits or savings. The payback period helps to determine the length of time required to. Web $400k ÷ $200k = 2 years Web general overview the template is constructed to evaluate potential major projects or investments that would require capital budgeting. Web types of payback period. Web this free template can calculate payback period calculator in excel, which will be used for making decisions. So, you can use the. Web pp = initial investment / cash flow for example, if you invested $10,000 in a business that gives you $2,000 per year,. Payback period = 1 million /2.5 lakh; Web feasibility metrics (npv, irr and payback period) excel template. Web a payback period is the time it takes for the cash flow generated by an investment to match or exceed its initial. Web this free template can calculate payback period calculator in excel, which will be used for making decisions. Payback period = 4 years; Web so, you calculate the payback period in excel by using the following steps: Payback period = 1 million /2.5 lakh; The payback period is the amount of time (usually measured in years) it. The payback period is the length of time required to recover the cost of an investment. The payback period is a measure organizations use to determine the time needed to recover the initial investment in a business project. Without any further ado, let’s get started with calculating the payback period in excel. Web the payback period is the time required in order that investment can repay its original costs in form of cash flow, profits or savings. This excel file will allow to calculate the net present value,. So, you can use the. Web how to build a payback period calculation template in excel using excel functions to calculate payback period. The payback period helps to determine the length of time required to. Web a payback period is the time it takes for the cash flow generated by an investment to match or exceed its initial. Web $400k ÷ $200k = 2 years Web payback period formula.Cara Menghitung Payback Period Dengan Excel Gudang Materi Online

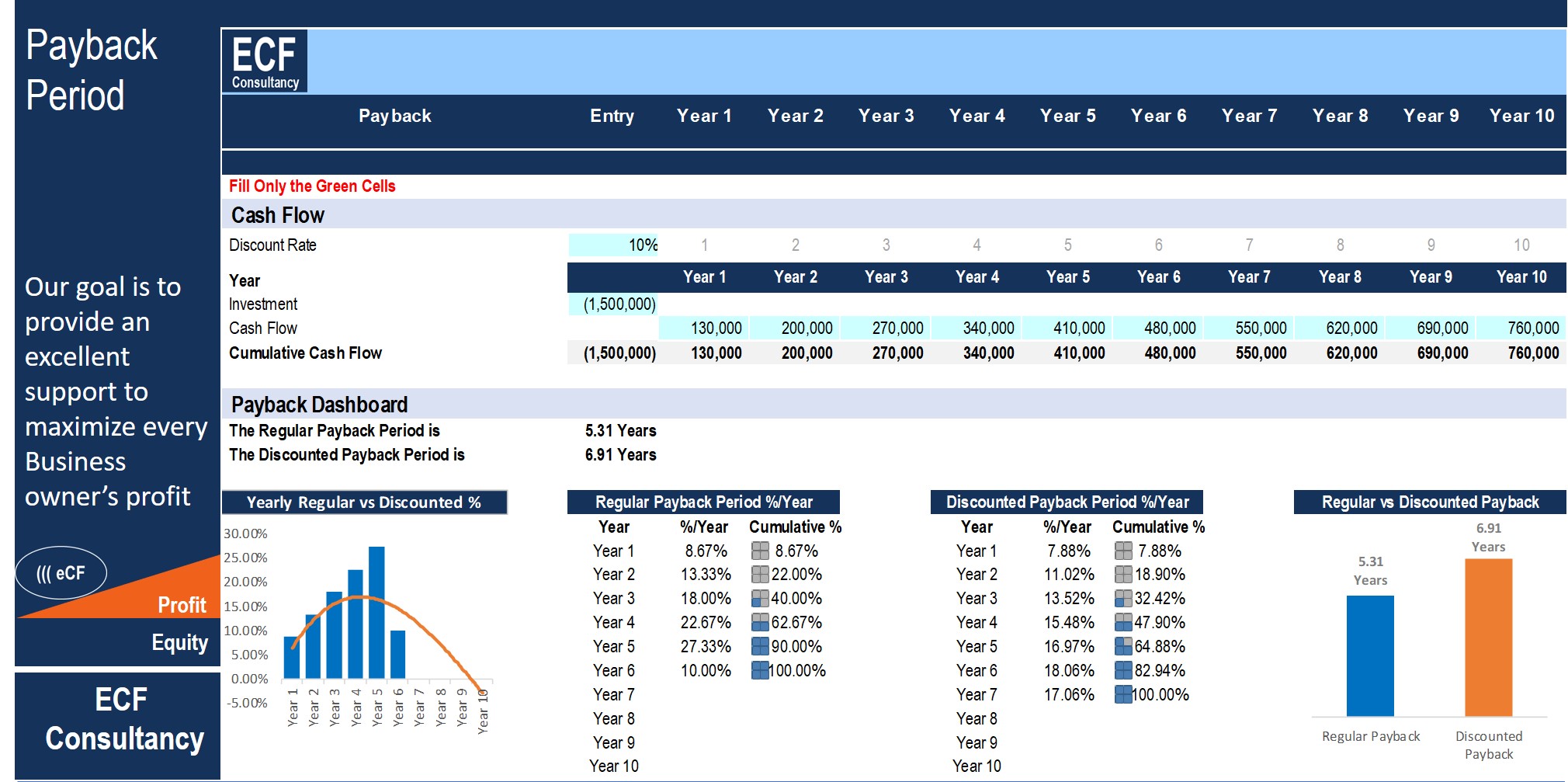

Payback Period Excel template • 365 Financial Analyst

TABLA DE POTENCIAS EN EXCEL YouTube

Payback Period Excel Model Eloquens

Payback Period Excel Template CFI Marketplace

How to Calculate Payback Period in Excel.

Payback Period Calculator Double Entry Bookkeeping

Payback period formula TracyHaumie

Payback Period Template Download Free Excel Template

How to Calculate Accounting Payback Period or Capital Budgeting Break

Web Pp = Initial Investment / Cash Flow For Example, If You Invested $10,000 In A Business That Gives You $2,000 Per Year,.

Web So By Adding Index(F19:M19,,Countif(F17:M17,”<0″)+1) And Countif(F17:M17,”<0″), You Get A.

Web Payback Period = Initial Investment Or Original Cost Of The Asset / Cash Inflows.

To Find Exactly When Payback Occurs, The Following Formula Can Be Used:

Related Post: