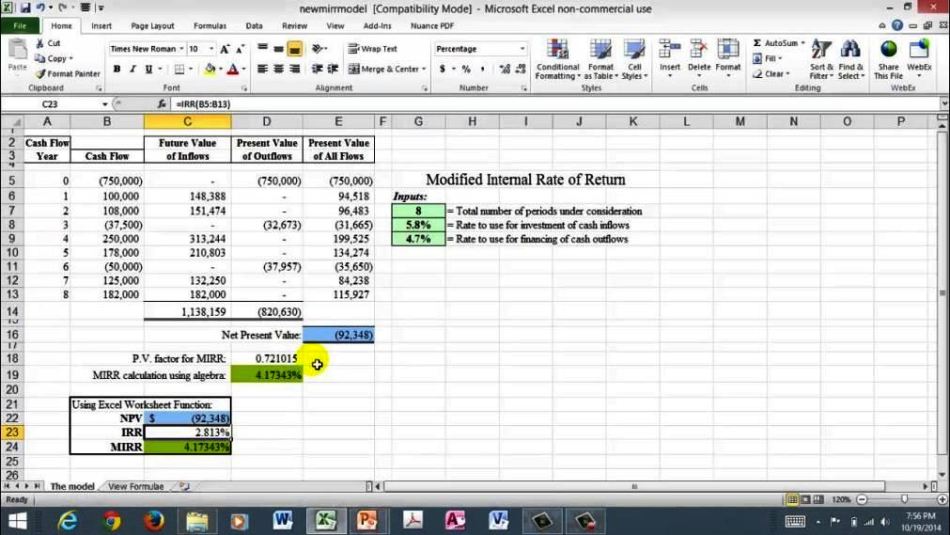

Npv Template Excel

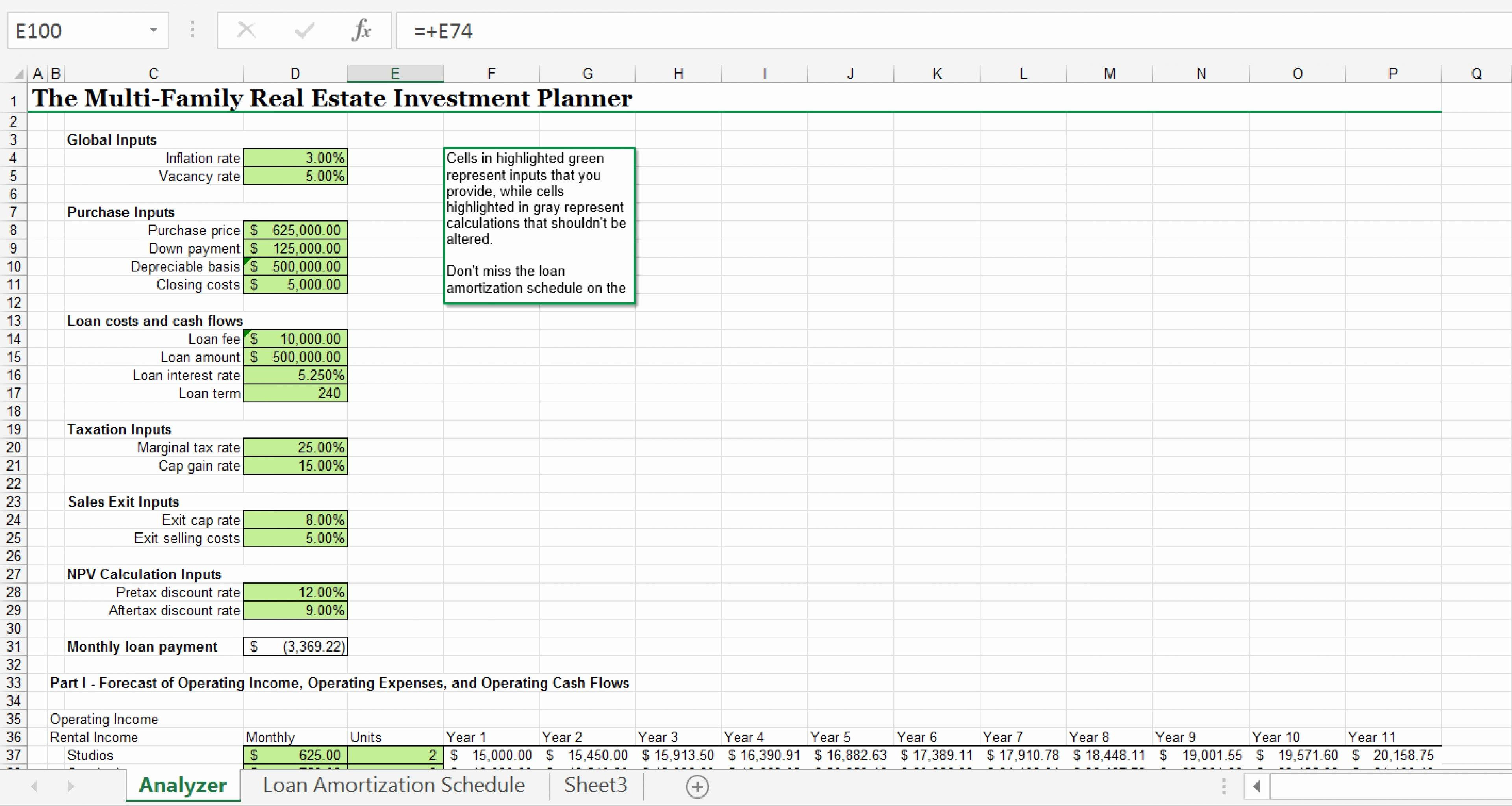

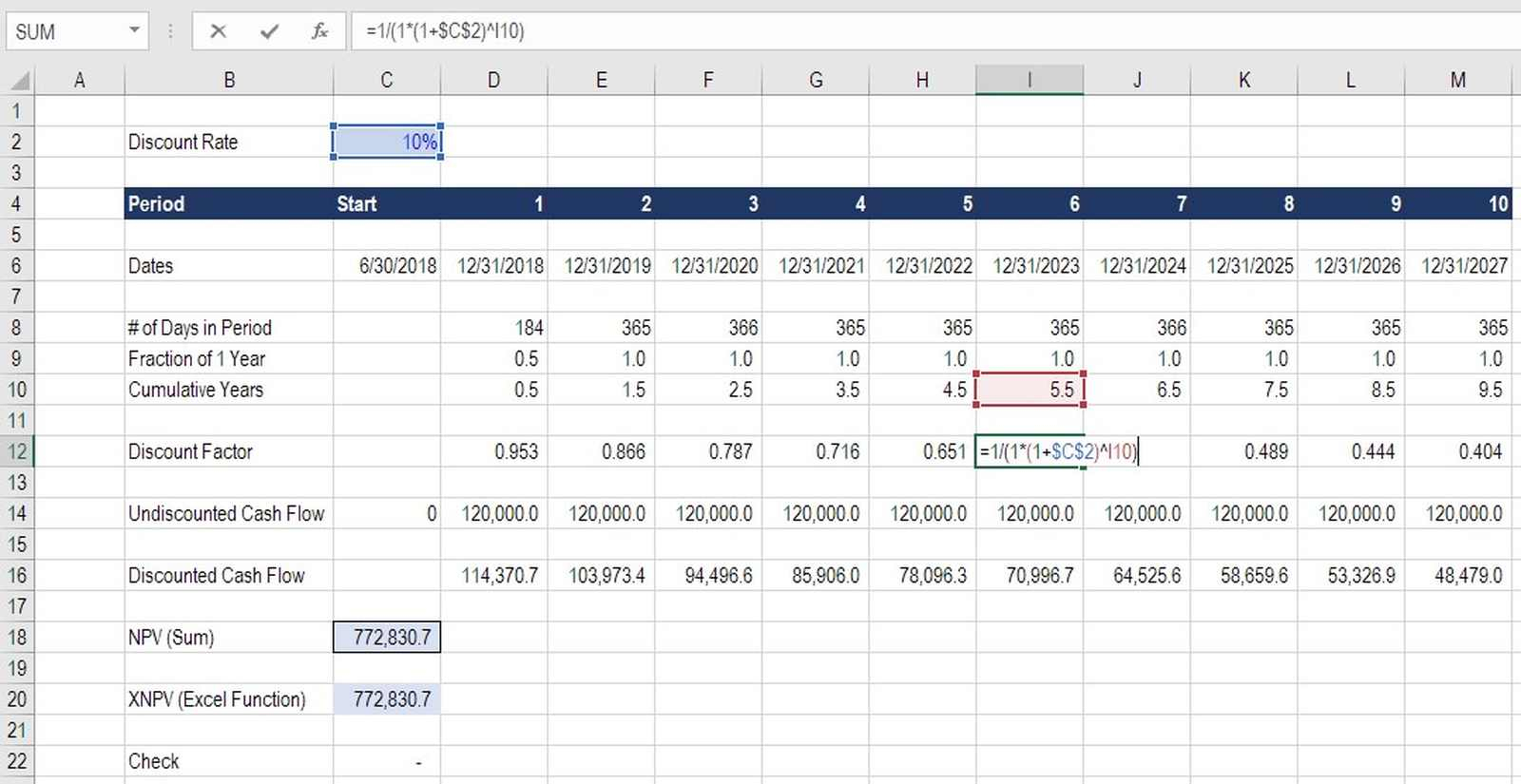

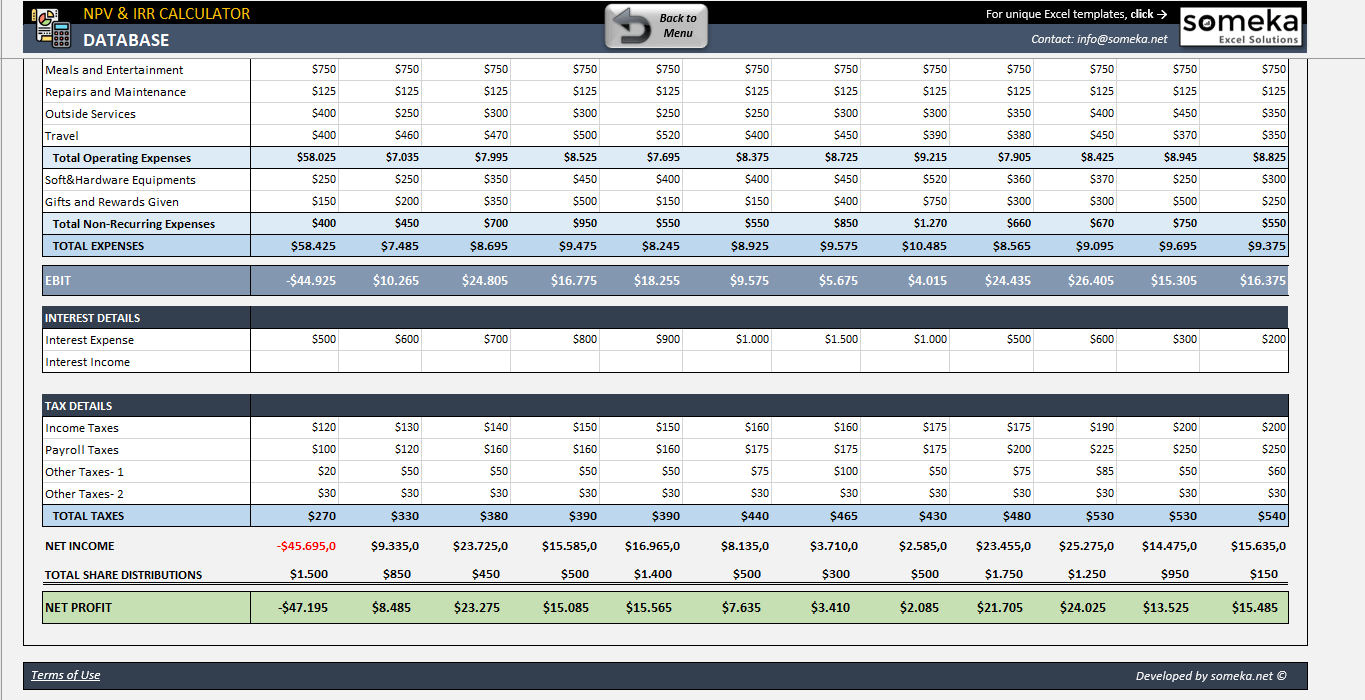

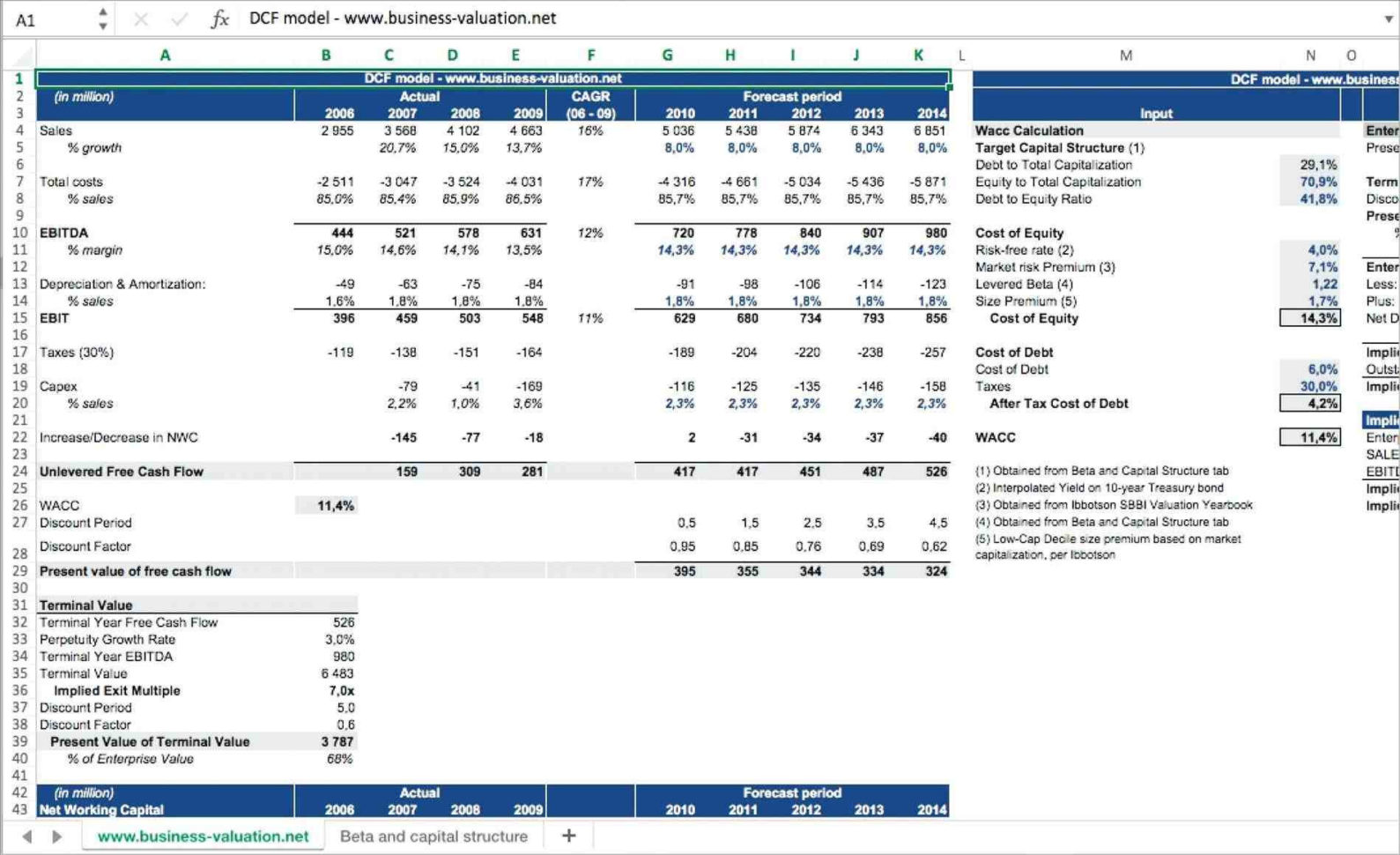

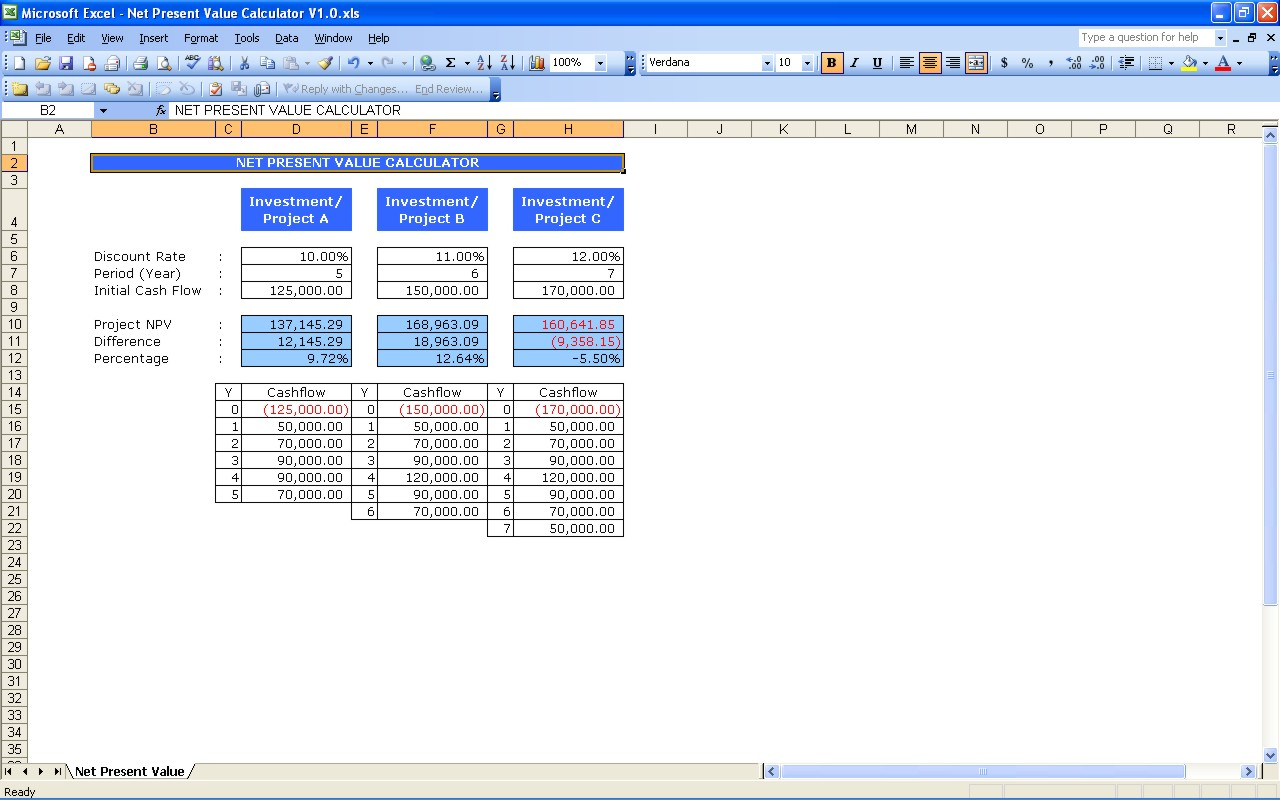

Npv Template Excel - To calculate npv or irr, you first need to have a predicted or estimated series of periodic cash. Web this net present value template helps you calculate net present value given the discount rate and. The correct npv formula in excel uses the npv function to calculate the present value of a. =xnpv (rate, values, dates) where: Similarly, we have to calculate it for. Web what is npv in excel? An npv of zero or higher forecasts profitability for a project or. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of. Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. First, we have to calculate the present value the output will be: The correct npv formula in excel uses the npv function to calculate the present value of a. Web how to calculate irr and npv in excel. An npv of zero or higher forecasts profitability for a project or. To calculate npv or irr, you first need to have a predicted or estimated series of periodic cash. Npv is an excel. Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. An npv of zero or higher forecasts profitability for a project or. Web how to calculate irr and npv in excel. Establish a series of cash. Web you can use excel to calculate npv instead of figuring it. First, we have to calculate the present value the output will be: The excel formula for xnpv is as follows: Web =npv (rate, value1, [value2],.) the above formula takes the following arguments: Web net present value | understanding the npv function. Web how to calculate irr and npv in excel. Web npv and irr calculations and template net present value (npv) and internal rate of return (irr) are metrics used to estimate roi. Similarly, we have to calculate it for. Rate → the appropriate discount. Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. The net present. Net present value is the current value of a future stream of cash flows discounted. Set a discount rate in a cell. Web npv in excel is also known as the net present value formula in excel, which is used to calculate the difference between the. The excel formula for xnpv is as follows: What is net present value? Web npv in excel is also known as the net present value formula in excel, which is used to calculate the difference between the. An npv of zero or higher forecasts profitability for a project or. Web you can use excel to calculate npv instead of figuring it manually. Npv is the value that represents the current value of all. Web this net present value template helps you calculate net present value given the discount rate and. Web the npv function in excel returns the net present value of an investment based on a discount or interest. Web how to calculate irr and npv in excel. Establish a series of cash. First, we have to calculate the present value the. Web what is npv in excel? First, we have to calculate the present value the output will be: Web let’s first understand what net present value means. Web you can use excel to calculate npv instead of figuring it manually. The correct npv formula in excel uses the npv function to calculate the present value of a. Rate → the appropriate discount. Web the npv function [1] is an excel financial function that will calculate the net present value (npv) for a series of. April 12, 2022 net present value is used in capital budgeting and. Similarly, we have to calculate it for. Web you can use excel to calculate npv instead of figuring it manually. Web npv in excel is also known as the net present value formula in excel, which is used to calculate the difference between the. Web the excel npv function calculates the net present value of an investment based on it’s discounted rate or rate of interest and a. The correct npv formula in excel uses the npv function to calculate. Set a discount rate in a cell. Net present value is the current value of a future stream of cash flows discounted. Web what is npv in excel? Web the npv function [1] is an excel financial function that will calculate the net present value (npv) for a series of. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of. Establish a series of cash. April 12, 2022 net present value is used in capital budgeting and. Web net present value | understanding the npv function. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. An npv of zero or higher forecasts profitability for a project or. The correct npv formula in excel uses the npv function to calculate the present value of a. Web you can use excel to calculate npv instead of figuring it manually. Rate → the appropriate discount. Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. Web example of how to use the npv function: Similarly, we have to calculate it for. Web npv and irr calculator excel template rated 4.62 out of 5 based on 13 customer ratings 4.62 ( 13 reviews ) professional excel spreadsheet to calculate. Web how to calculate irr and npv in excel. Npv is an excel financial function that determines the difference between the present value of. Web net present value excel template updated: Web net present value | understanding the npv function. Web npv calculates that present value for each of the series of cash flows and adds them together to get the net present value. Web let’s first understand what net present value means. Web what is npv in excel? Web the npv function [1] is an excel financial function that will calculate the net present value (npv) for a series of. Web you can use excel to calculate npv instead of figuring it manually. Web the npv function in excel returns the net present value of an investment based on a discount or interest. Establish a series of cash. What is net present value? Web this net present value template helps you calculate net present value given the discount rate and. Web npv and irr calculations and template net present value (npv) and internal rate of return (irr) are metrics used to estimate roi. An npv of zero or higher forecasts profitability for a project or. Set a discount rate in a cell. Similarly, we have to calculate it for. To calculate npv or irr, you first need to have a predicted or estimated series of periodic cash. The correct npv formula in excel uses the npv function to calculate the present value of a.10 Npv Template Excel Excel Templates Excel Templates

Npv Excel Spreadsheet Template —

Trending Discount Factor Formula Excel Pics Formulas

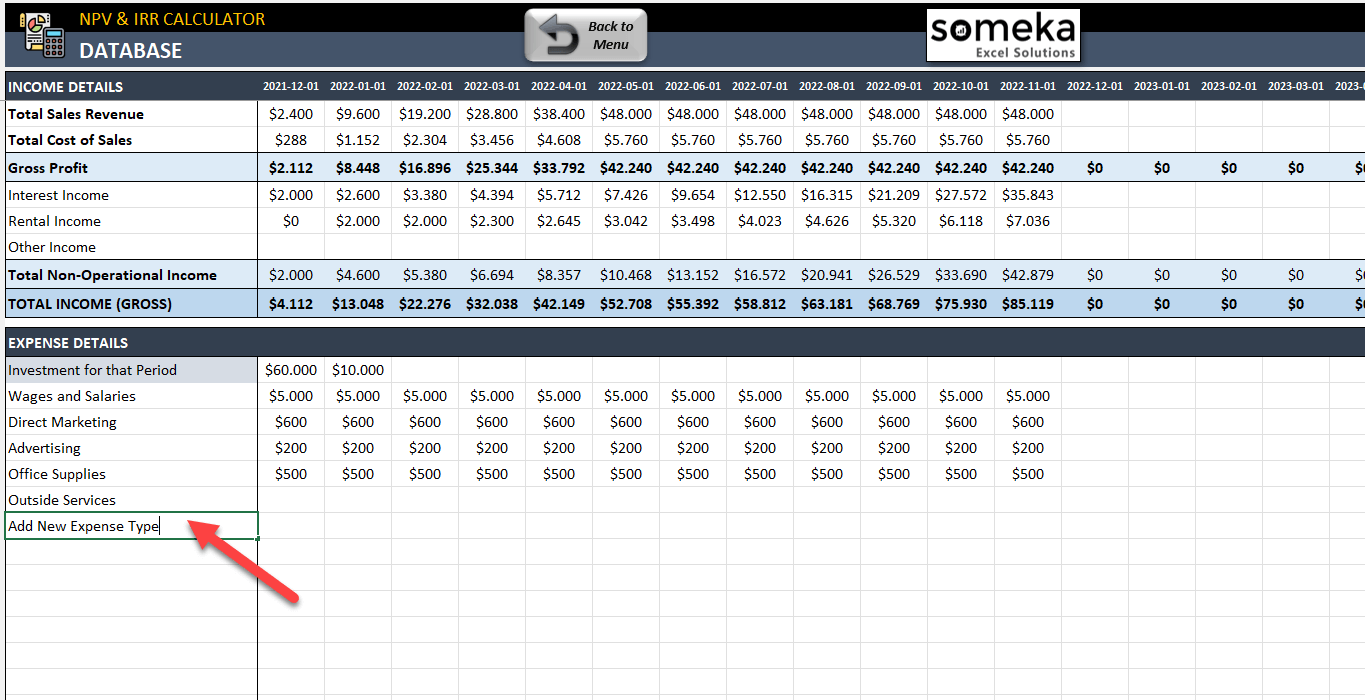

NPV Calculator Template Free NPV & IRR Calculator Excel Template

Npv Excel Spreadsheet Template —

Npv Excel ubicaciondepersonas.cdmx.gob.mx

Npv Calculator Excel Template SampleTemplatess SampleTemplatess

Npv Excel Spreadsheet Template —

10 Npv Irr Excel Template Excel Templates

Download free Excel examples

Npv Is The Value That Represents The Current Value Of All The Future Cash Flows Without The Initial.

Web Example Of How To Use The Npv Function:

The Net Present Value (Npv) Of An Investment Is The Present Value Of Its Future Cash Inflows Minus The Present Value Of.

Web Net Present Value Excel Template Updated:

Related Post: