Net Present Value Excel Template

Net Present Value Excel Template - Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. Download the free excel template now to advance your finance knowledge! Web it is used to determine the profitability you derive from a project. Web how to use the npv formula in excel. Web net present value template. Irr irr is based on npv. Suppose we are given the following data on cash inflows and outflows: Web how do you calculate net present value in excel? Web in this tutorial, i have covered how to calculate net present values in excel using npv and xnpv methods. You can use the basic formula, calculate the present value of each component for. Web the net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows. Suppose we are given the following data on cash inflows and outflows: Web net present value template. Web excel templates calculating net present value (npv) using excel calculating net present value (npv) using excel in finance, it. Web it is used to determine the profitability you derive from a project. Web fact checked by ariel courage present value (pv) is the current value of an expected future stream of cash flow. Web the net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows. You can use. Web net present value template. Web let’s first understand what net present value means. Where n is the number of cash flows, and i is the interest or discount rate. Cfn = cash flow in the nth period. Most financial analysts never calculate the net present value by hand. Most financial analysts never calculate the net present value by hand. Web net present value template. Cfn = cash flow in the nth period. Web what is net present value (npv)? Web there are two methods to calculate net present value in excel. Web the formula for npv is: Cfn = cash flow in the nth period. You can use the basic formula, calculate the present value of each component for. Where, n = period which takes values from 0 to the nth period till the cash flows ending period. Download the free excel template now to advance your finance knowledge! Let me explain with an example. Web download how to use net present value calculator excel template? This calculator is very simple and easy to use. Companies use the net present value (npv). Web let’s first understand what net present value means. Suppose we are given the following data on cash inflows and outflows: Npv in excel is a bit tricky, because of how the function is implemented. Web how do you calculate net present value in excel? You can use our free npv calculator to calculate the net. Web the formula for npv is: This net present value template helps you calculate net present value given the. The discount rate is the rate for one period, assumed to be annual. Web it is used to determine the profitability you derive from a project. Web let’s first understand what net present value means. Web what is net present value (npv)? This net present value template helps you calculate net present value given the. Net present value (npv) is the value of a series of cash flows over the entire. Web what is net present value (npv)? In other words, you can find out the value of future incomes discounted to the present value. With the help of the net present. With the help of the net present. Web it is used to determine the profitability you derive from a project. Web net present value template. Download the free excel template now to advance your finance knowledge! Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. Web it is used to determine the profitability you derive from a project. Npv in excel is a bit tricky, because of how the function is implemented. Web the formula for npv is: Web npv calculates the net present value (npv) of an investment using a discount rate and a series of future cash flows. Web there are two methods to calculate net present value in excel. In other words, you can find out the value of future incomes discounted to the present value. Web the net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows. Most financial analysts never calculate the net present value by hand. Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. The discount rate is the rate for one period, assumed to be annual. You can use our free npv calculator to calculate the net. Web net present value template. This calculator is very simple and easy to use. Suppose we are given the following data on cash inflows and outflows: Companies use the net present value (npv). Web npv and irr calculator excel template rated 4.62 out of 5 based on 13 customer ratings 4.62 ( 13 reviews ) professional excel. Irr irr is based on npv. Web how do you calculate net present value in excel? Web how to use the npv formula in excel. You can use our free npv calculator to calculate the net. Web there are two methods to calculate net present value in excel. Web understanding the npv function the npv function simply calculates the present value of a series of future cash flows. This net present value template helps you calculate net present value given the. Most financial analysts never calculate the net present value by hand. Npv is the value that represents the current value of all the future cash flows without the initial investment. Web the formula for npv is: Companies use the net present value (npv). Web net present value template. Web formula for the net present value is given below: Cfn = cash flow in the nth period. Web the net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and outflows. Net present value (npv) is the value of a series of cash flows over the entire. Web fact checked by ariel courage present value (pv) is the current value of an expected future stream of cash flow. You can use the basic formula, calculate the present value of each component for. The discount rate is the rate for one period, assumed to be annual. Suppose we are given the following data on cash inflows and outflows:Net Present Value Calculator Excel Template SampleTemplatess

Net Present Value Calculator Excel Templates

Net Present Value Formula Examples With Excel Template

10 Excel Net Present Value Template Excel Templates

Professional Net Present Value Calculator Excel Template Excel TMP

Net Present Value Calculator »

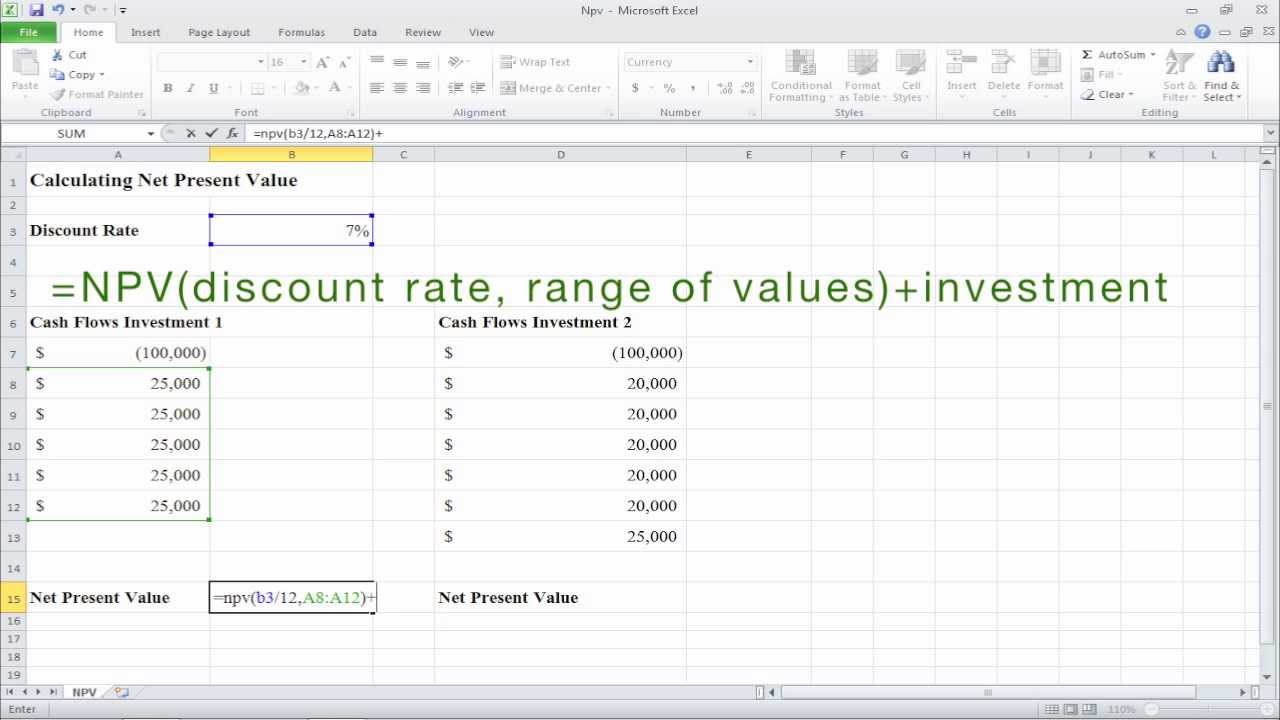

How to Calculate Net Present Value (Npv) in Excel YouTube

10 Excel Net Present Value Template Excel Templates

8 Npv Calculator Excel Template Excel Templates

Best Net Present Value Formula Excel transparant Formulas

You Can Use Our Free Npv Calculator To Calculate The Net.

Download The Free Excel Template Now To Advance Your Finance Knowledge!

Web In This Tutorial, I Have Covered How To Calculate Net Present Values In Excel Using Npv And Xnpv Methods.

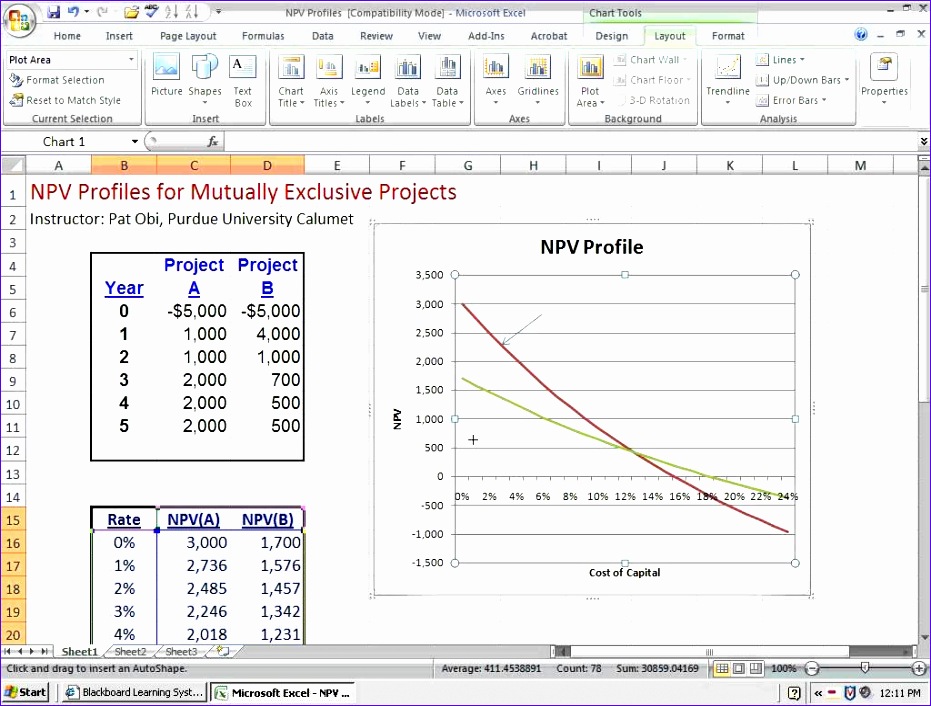

Irr Irr Is Based On Npv.

Related Post: