Futures Contract Template

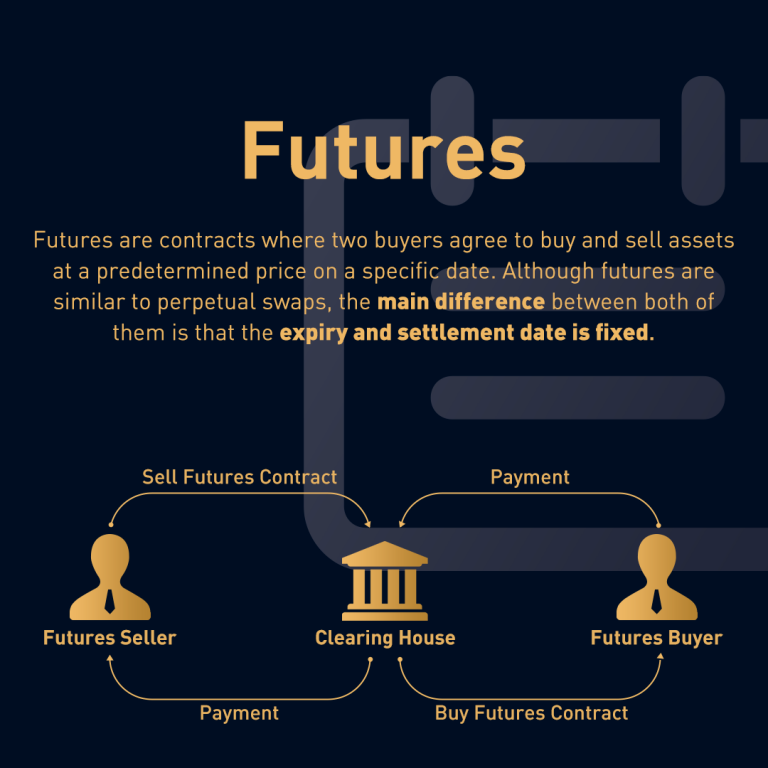

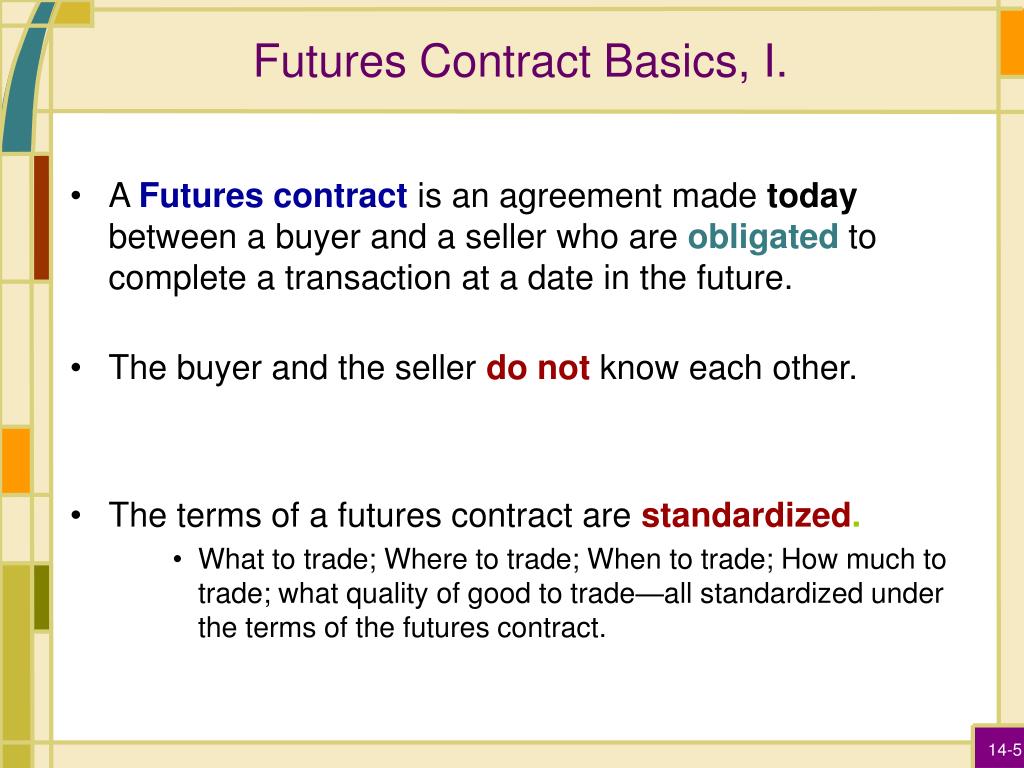

Futures Contract Template - Web a “futures contract is an agreement between two anonymous market participants”, a seller and a buyer. These contracts will specify the price the asset will be exchanged for, the exact time of expiry, and the quantity of goods. Futures can be traded with over 30x leverage and are risky because of that leverage. Current value if the current. The custodian shall, upon receipt of proper instructions, receive and retain confirmations and other documents,. Web in finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a. Which can be in the form of a. A futures contract is a contract between two parties where both parties agree to buy and sell a particular. The buyer should buy and receive the underlying asset when the futures contract expires. Web a futures contract is an agreement to trade a commodity, currency, or stock at a set price, amount, and date. Web written by cfi team published june 6, 2021 updated january 19, 2023 what is an equity futures contract? These contracts will specify the price the asset will be exchanged for, the exact time of expiry, and the quantity of goods. Web learn why traders use futures, how to trade futures, and what steps you should take to get started.. Web definition a futures contract is essentially a promise to buy or sell an asset in the future, and traders can buy and sell these promises. Futures contracts can be used to speculate on commodities, currencies and indices. The buyer should buy and receive the underlying asset when the futures contract expires. Web learn why traders use futures, how to. A futures contract is a contract between two parties where both parties agree to buy and sell a particular. These contracts will specify the price the asset will be exchanged for, the exact time of expiry, and the quantity of goods. The custodian shall, upon receipt of proper instructions, receive and retain confirmations and other documents,. Current value if the. The buyer should buy and receive the underlying asset when the futures contract expires. Web if, in five months’ time when the futures contract expires, the spot price is still $1,700 a tonne, the writer of the contract owes. Web pete rathburn investopedia / michela buttignol what are futures? A futures contract is a contract between two parties where both. Web pete rathburn investopedia / michela buttignol what are futures? The buyer should buy and receive the underlying asset when the futures contract expires. Web a “futures contract is an agreement between two anonymous market participants”, a seller and a buyer. Web a futures contract is a legal agreement to buy or sell a particular commodity asset, or security at. Current value if the current. Web a “futures contract is an agreement between two anonymous market participants”, a seller and a buyer. Web learn online now what is a futures contract? Futures can be traded with over 30x leverage and are risky because of that leverage. As discussed in our previous blog, forwards. Web futures contracts are agreements made for an underlying asset; These contracts will specify the price the asset will be exchanged for, the exact time of expiry, and the quantity of goods. Futures contracts can be used to speculate on commodities, currencies and indices. Web if, in five months’ time when the futures contract expires, the spot price is still. Web futures contracts are agreements made for an underlying asset; Web a “futures contract is an agreement between two anonymous market participants”, a seller and a buyer. As discussed in our previous blog, forwards. Web a futures contract is an agreement to trade a commodity, currency, or stock at a set price, amount, and date. Web in finance, a futures. Current value if the current. As discussed in our previous blog, forwards. Web written by cfi team published june 6, 2021 updated january 19, 2023 what is an equity futures contract? Web if, in five months’ time when the futures contract expires, the spot price is still $1,700 a tonne, the writer of the contract owes. The custodian shall, upon. Web written by cfi team published june 6, 2021 updated january 19, 2023 what is an equity futures contract? A futures contract is a contract between two parties where both parties agree to buy and sell a particular. The futures contract defines the price these assets will trade for and the time at which the trade will take place. Futures. Businesses use futures contracts to hedge risk, and traders may use them to place speculative bets. Web learn online now what is a futures contract? A futures contract is a contract between two parties where both parties agree to buy and sell a particular. Web in finance, a futures contract (sometimes called futures) is a standardized legal contract to buy or sell something at a. Futures are derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date. Web pete rathburn investopedia / michela buttignol what are futures? Web the futures contract is an extension of the forwards contract. Web if, in five months’ time when the futures contract expires, the spot price is still $1,700 a tonne, the writer of the contract owes. Web definition a futures contract is essentially a promise to buy or sell an asset in the future, and traders can buy and sell these promises. Web a “futures contract is an agreement between two anonymous market participants”, a seller and a buyer. As discussed in our previous blog, forwards. These contracts will specify the price the asset will be exchanged for, the exact time of expiry, and the quantity of goods. Web 4 min lesson 1 of 19 definition of a futures contract what is a futures contract? Which can be in the form of a. Web a futures contract is an agreement to buy or sell an asset at some point in the future. Web learn why traders use futures, how to trade futures, and what steps you should take to get started. Current value if the current. The buyer should buy and receive the underlying asset when the futures contract expires. Web written by cfi team published june 6, 2021 updated january 19, 2023 what is an equity futures contract? Futures can be traded with over 30x leverage and are risky because of that leverage. Which can be in the form of a. Web a futures contract is a standardized agreement to buy or sell the underlying commodity or other asset at a. Web the futures contract is an extension of the forwards contract. Futures are derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date. Web a futures contract is an agreement to buy or sell an asset at some point in the future. Web written by cfi team published june 6, 2021 updated january 19, 2023 what is an equity futures contract? Web a futures contract is an agreement to trade a commodity, currency, or stock at a set price, amount, and date. The futures contract defines the price these assets will trade for and the time at which the trade will take place. The buyer should buy and receive the underlying asset when the futures contract expires. In all its practicality, a futures contract is only a developed form of the forward contract. Web a “futures contract is an agreement between two anonymous market participants”, a seller and a buyer. Web learn why traders use futures, how to trade futures, and what steps you should take to get started. The custodian shall, upon receipt of proper instructions, receive and retain confirmations and other documents,. Current value if the current. Web 4 min lesson 1 of 19 definition of a futures contract what is a futures contract? Futures contracts can be used to speculate on commodities, currencies and indices.(PDF) Analysis on the Effect of New Futures Contract Coming into Market

Futures Contract How do they Work

What Are Futures And Should You Invest In Them? Rocket HQ

Contrats Futures Or Royale Bourse

Ultimate Guide to Understanding Perpetual Futures Contracts 2021

PPT Futures Contracts PowerPoint Presentation, free download ID4407040

What are Futures Contract? Meaning, Examples & Uses Fintrakk

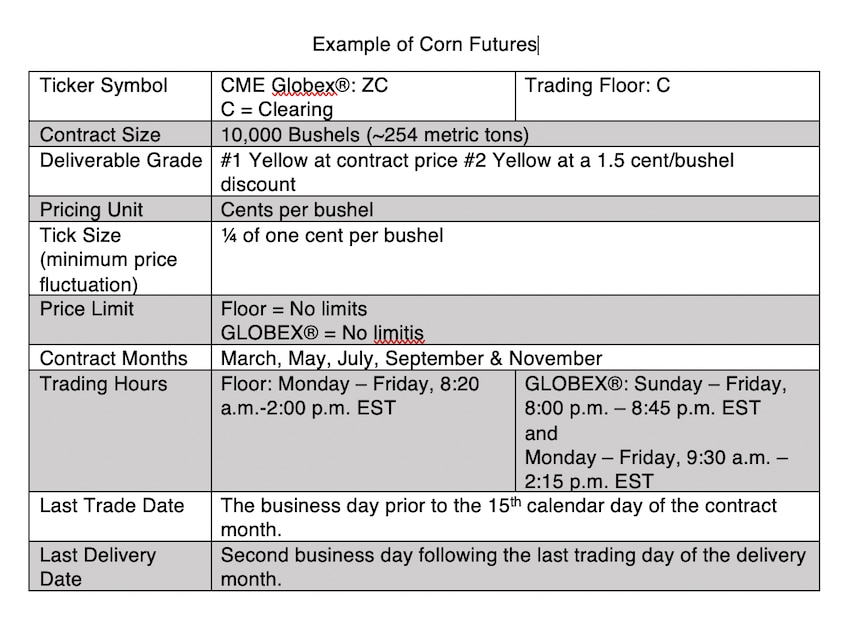

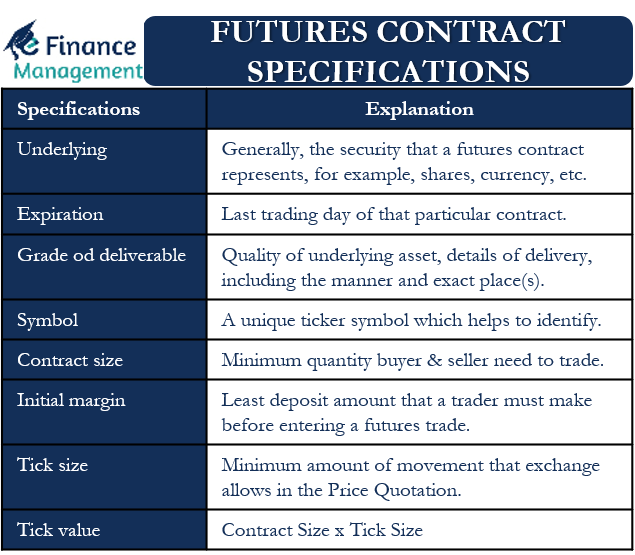

Futures Contract Specifications All You Need to Know

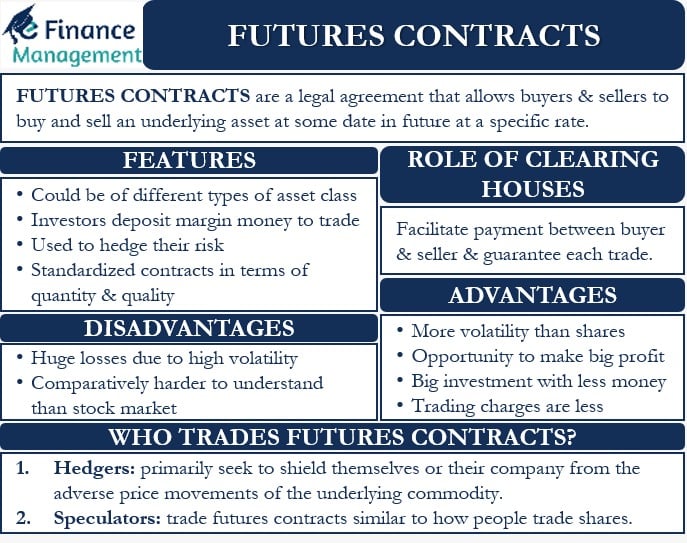

Futures Contracts Meaning, Features, Pros, Cons and More

Futures Contract Characteristics YouTube

These Contracts Will Specify The Price The Asset Will Be Exchanged For, The Exact Time Of Expiry, And The Quantity Of Goods.

Web If, In Five Months’ Time When The Futures Contract Expires, The Spot Price Is Still $1,700 A Tonne, The Writer Of The Contract Owes.

As Discussed In Our Previous Blog, Forwards.

Futures Can Be Traded With Over 30X Leverage And Are Risky Because Of That Leverage.

Related Post: