Discounted Cash Flow Template

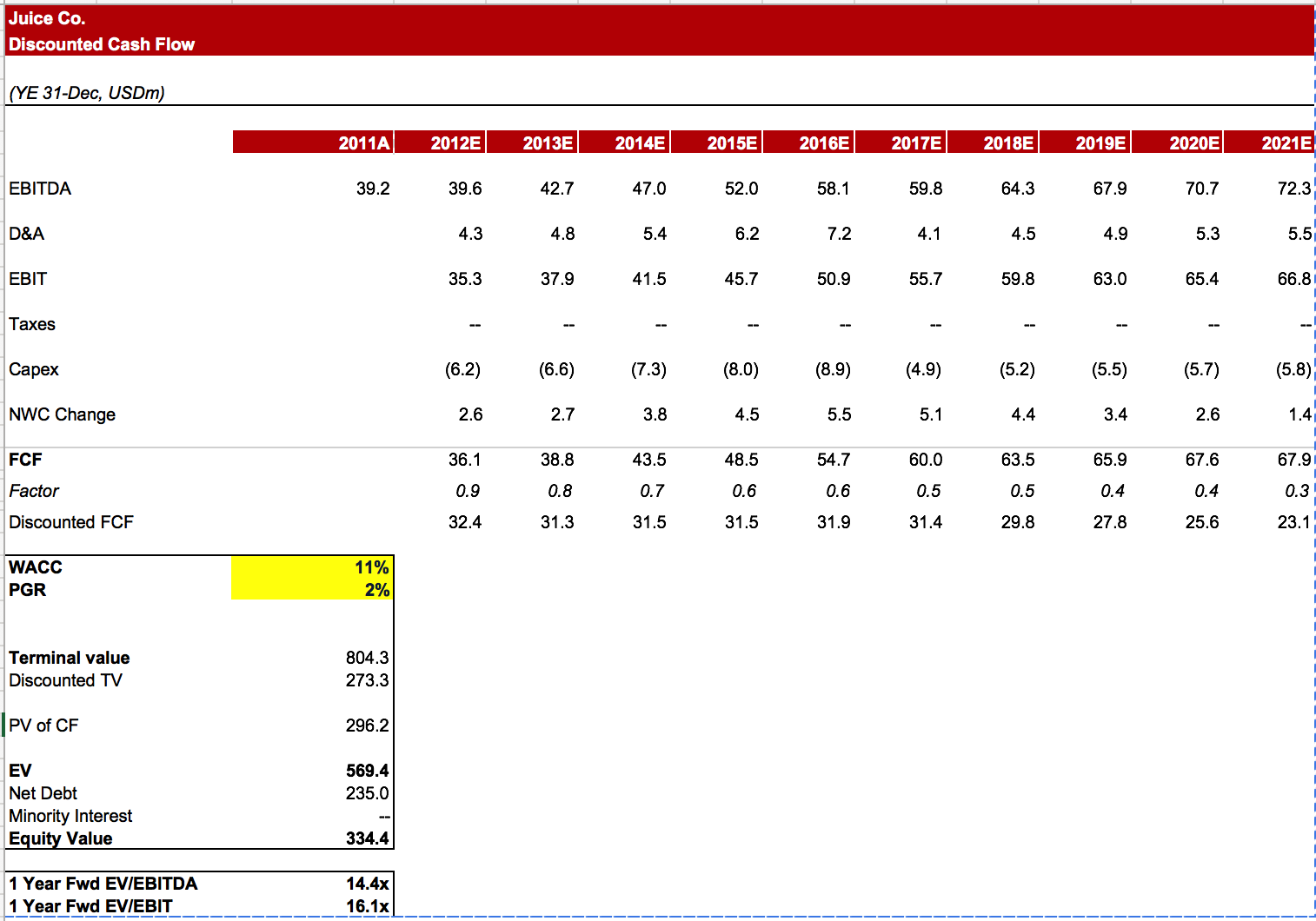

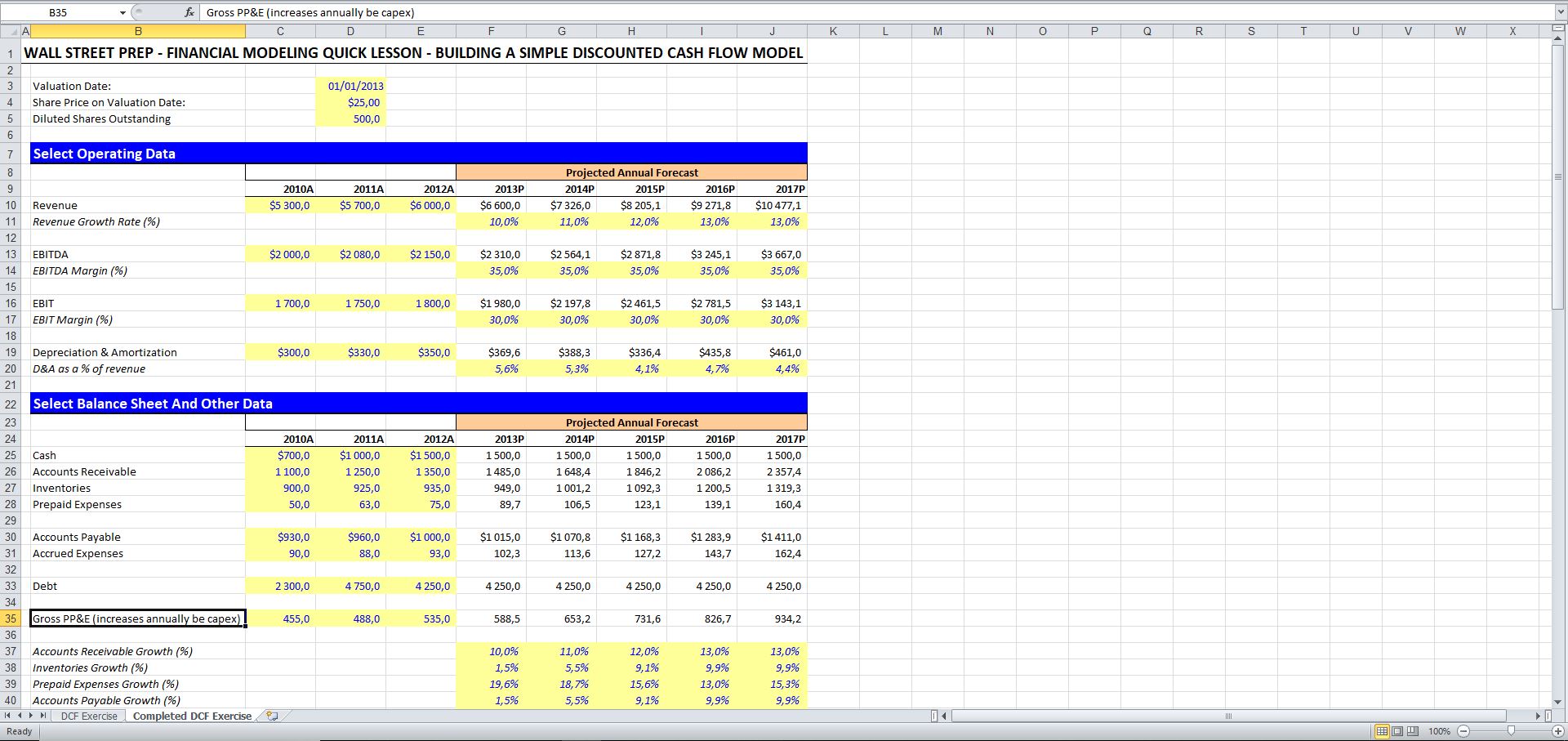

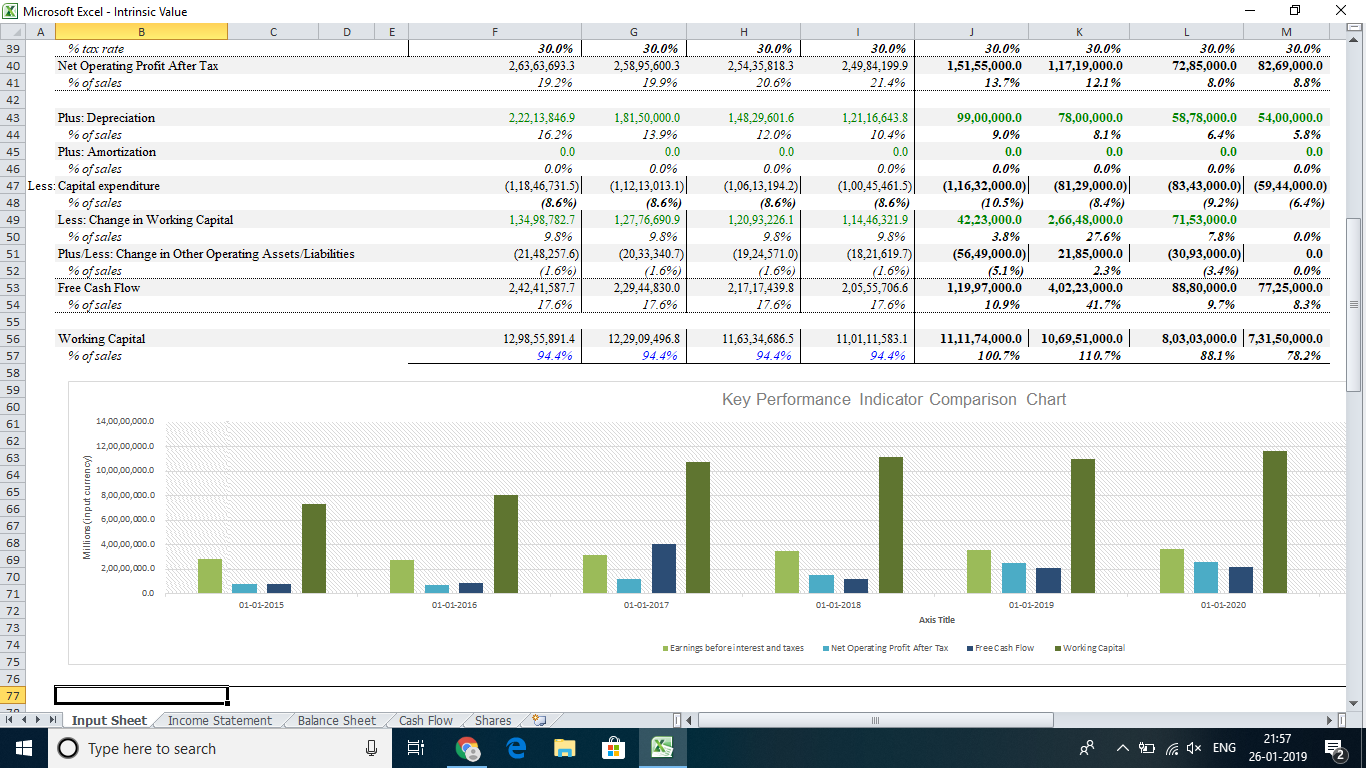

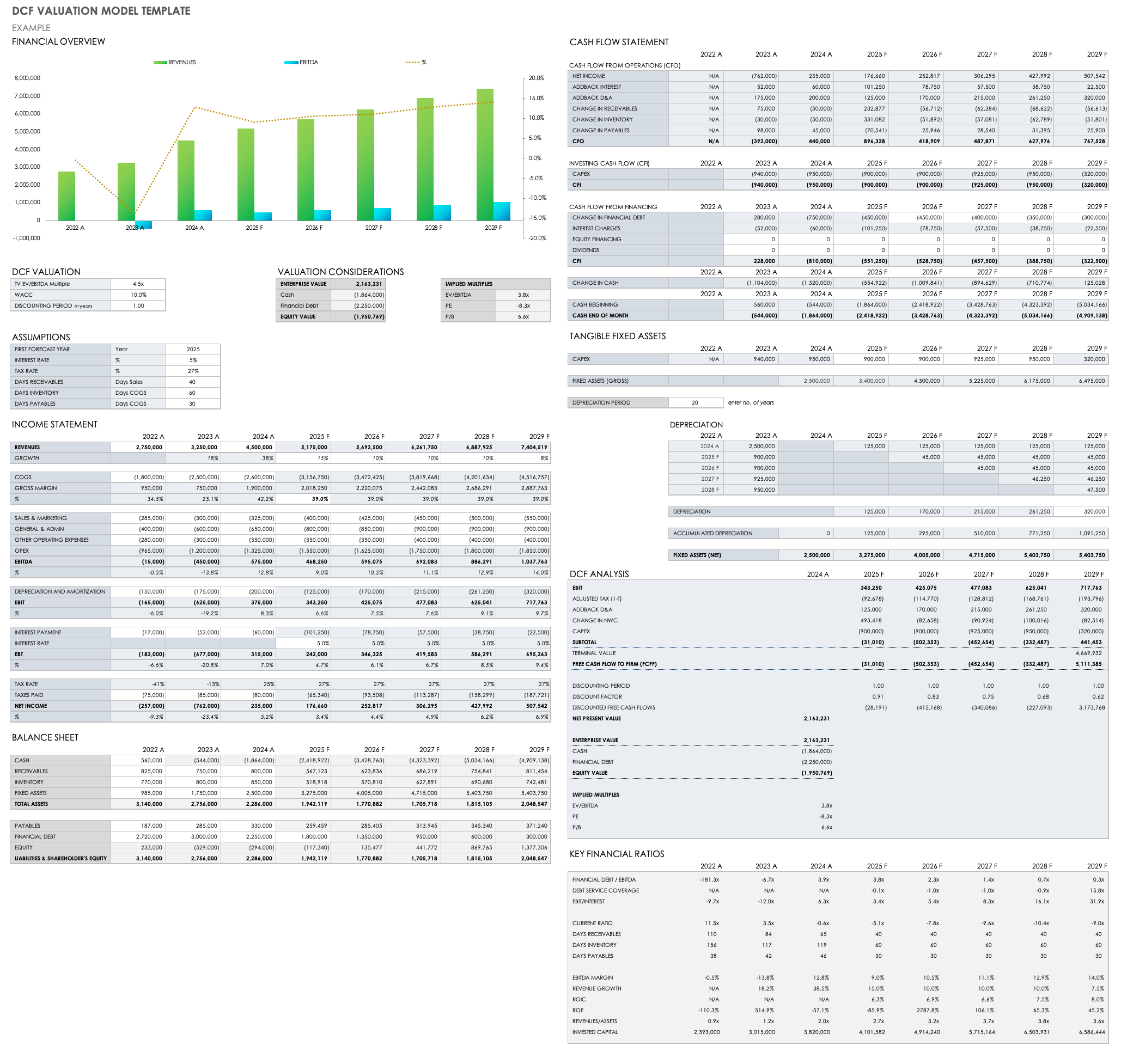

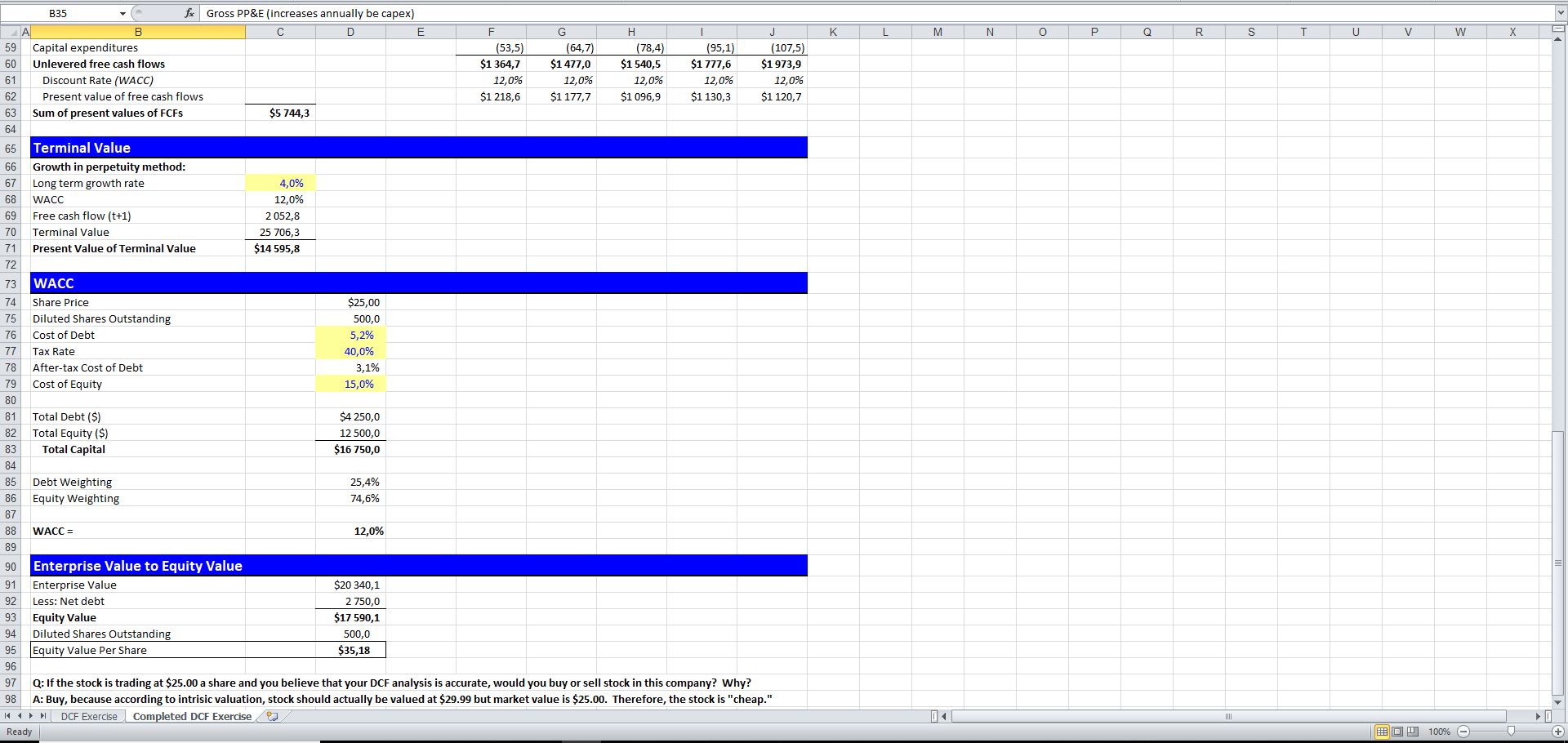

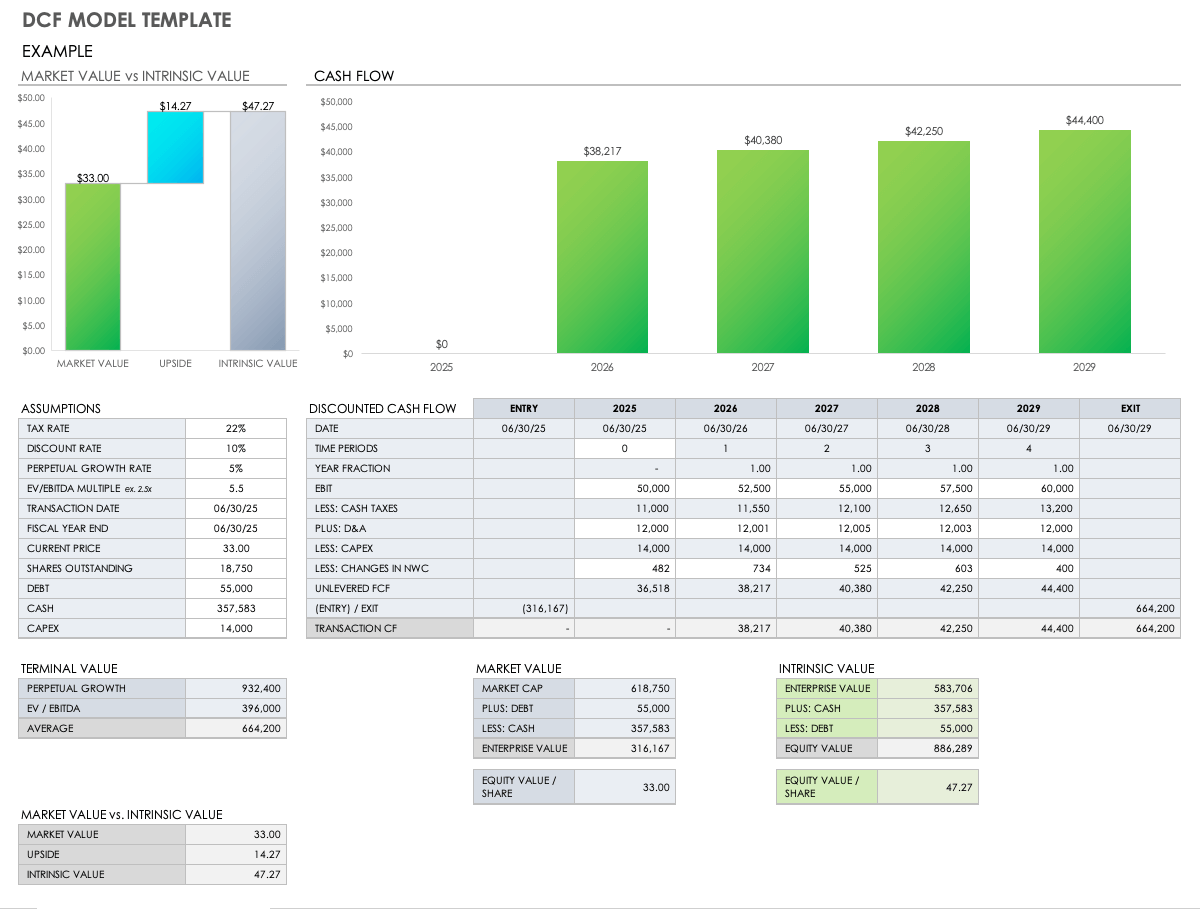

Discounted Cash Flow Template - Web on this page, you’ll find the following: The template comes with various. This dcf model template helps you: Enter the assumptions on discount rate and terminal growth rate. This guide will go over the dcf calculation so you. This template allows you to build. Web here is the equation: Web simply put, dcf can help you determine the value of an asset. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current, present value. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web discounted cash flow (dcf). The discount rate and cash flow growth rate stop changing because the company is mature. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the company reaches maturity or “stabilization” by the end. Enter the assumptions on discount rate and terminal growth rate. Web discounted cash. Web summary text this video opens with an explanation of the objective of a discounted cash flow (“dcf”) model. Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash. Download wso's free discounted cash flow (dcf) model template below! Web period #1 (explicit forecast period): The template comes with various. Web discounted cash flow is simply a method that professionals use when estimating an investment’s value. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current, present value. Web the discounted cash flow (dcf) is a valuation method. Web period #1 (explicit forecast period): Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current, present value. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its. Web. Web on this page, you’ll find the following: Web finance discounted cash flow (dcf) discounted cash flow (dcf) models 3 comments what is discounted cash flow?. Download wso's free discounted cash flow (dcf) model template below! Web here is the equation: Dcfs are widely used in both academia and in practice. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into. Web discounted cash. This dcf model template helps you: Discounted cash flow is a financial analysis computing future years’ forecasted cash. This guide will go over the dcf calculation so you. Web here is the equation: Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them. Web discounted cash flow is an analysis model that helps finance professionals determine the potential. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. Discounted cash flow is a financial analysis computing future years’ forecasted cash. Web discounted cash flow is simply a method that professionals use when estimating an investment’s value.. The template comes with various. The company’s cash flow, cash flow growth rate, and potentially even the discount rate change over 5, 10, 15, or 20+ years, but the company reaches maturity or “stabilization” by the end. Web finance discounted cash flow (dcf) discounted cash flow (dcf) models 3 comments what is discounted cash flow?. Web download simple cash flow. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. This guide will go over the dcf calculation so you. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its. This template allows you to build. Web download simple cash flow template excel | smartsheet this template works for any length of time and allows you to compare different. Web discounted cash flow is an analysis model that helps finance professionals determine the potential. Web discounted cash flow is simply a method that professionals use when estimating an investment’s value. Web period #1 (explicit forecast period): This dcf model template helps you: Dcf is the sum of all future discounted cash flows that the investment is expected to. Discounted cash flow is a financial analysis computing future years’ forecasted cash. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current, present value. Dcfs are widely used in both academia and in practice. Web here is the equation: Web finance discounted cash flow (dcf) discounted cash flow (dcf) models 3 comments what is discounted cash flow?. The discounted cash flow formula; Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Tips for doing a discounted cash flow. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into. Web simply put, dcf can help you determine the value of an asset. Discounted cash flow is a financial analysis computing future years’ forecasted cash. This template allows you to build. The discounted cash flow formula; Web simply put, dcf can help you determine the value of an asset. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. Web here is the equation: Web discounted cash flow (dcf) is an analysis method used to value investment by discounting the estimated future cash. Enter the assumptions on discount rate and terminal growth rate. Web discounted cash flow is an analysis model that helps finance professionals determine the potential. Web the discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a current, present value. Download wso's free discounted cash flow (dcf) model template below! The template comes with various. Dcfs are widely used in both academia and in practice. Web summary text this video opens with an explanation of the objective of a discounted cash flow (“dcf”) model. Web takeaways what is discounted cash flow? Web period #1 (explicit forecast period):Discounted Cash Flow (DCF) Model Template Wall Street Oasis

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

Discounted Cash Flow Excel Model Template Eloquens

Cash Flow Analysis Template 11+ Download Free Documents in PDF, Word

7 Cash Flow Analysis Template Excel Excel Templates

Free Discounted Cash Flow Templates Smartsheet

Free Discounted Cash Flow Templates Smartsheet

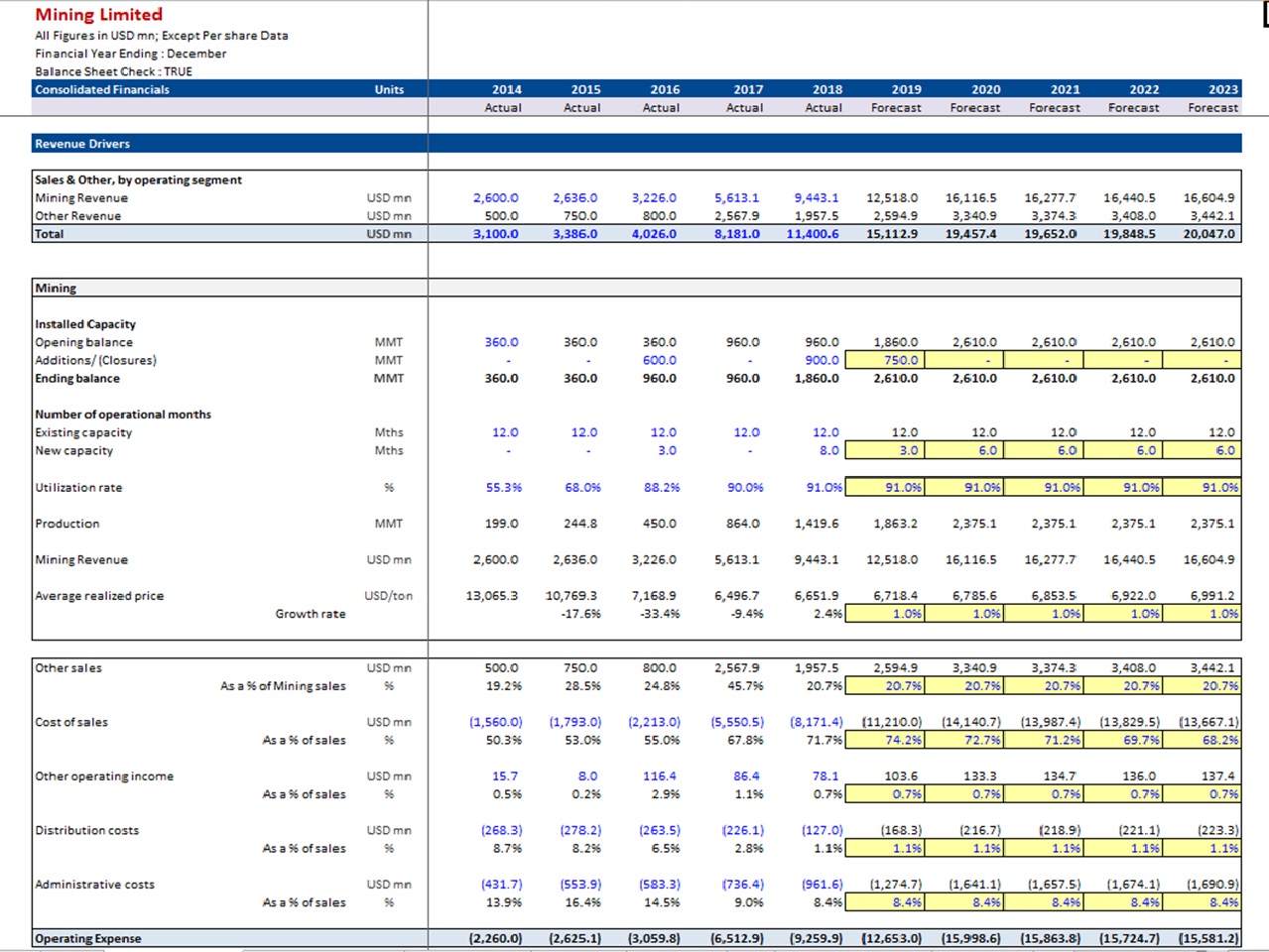

Discounted Cash Flow DCF Valuation Model Template (Mining Company

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

Free Discounted Cash Flow Templates Smartsheet

The Company’s Cash Flow, Cash Flow Growth Rate, And Potentially Even The Discount Rate Change Over 5, 10, 15, Or 20+ Years, But The Company Reaches Maturity Or “Stabilization” By The End.

Web Discounted Cash Flow Is Simply A Method That Professionals Use When Estimating An Investment’s Value.

Web The Discounted Cash Flow (Dcf) Formula Is Equal To The Sum Of The Cash Flow In Each Period Divided By One Plus The.

This Guide Will Go Over The Dcf Calculation So You.

Related Post: