Discounted Cash Flow Model Template

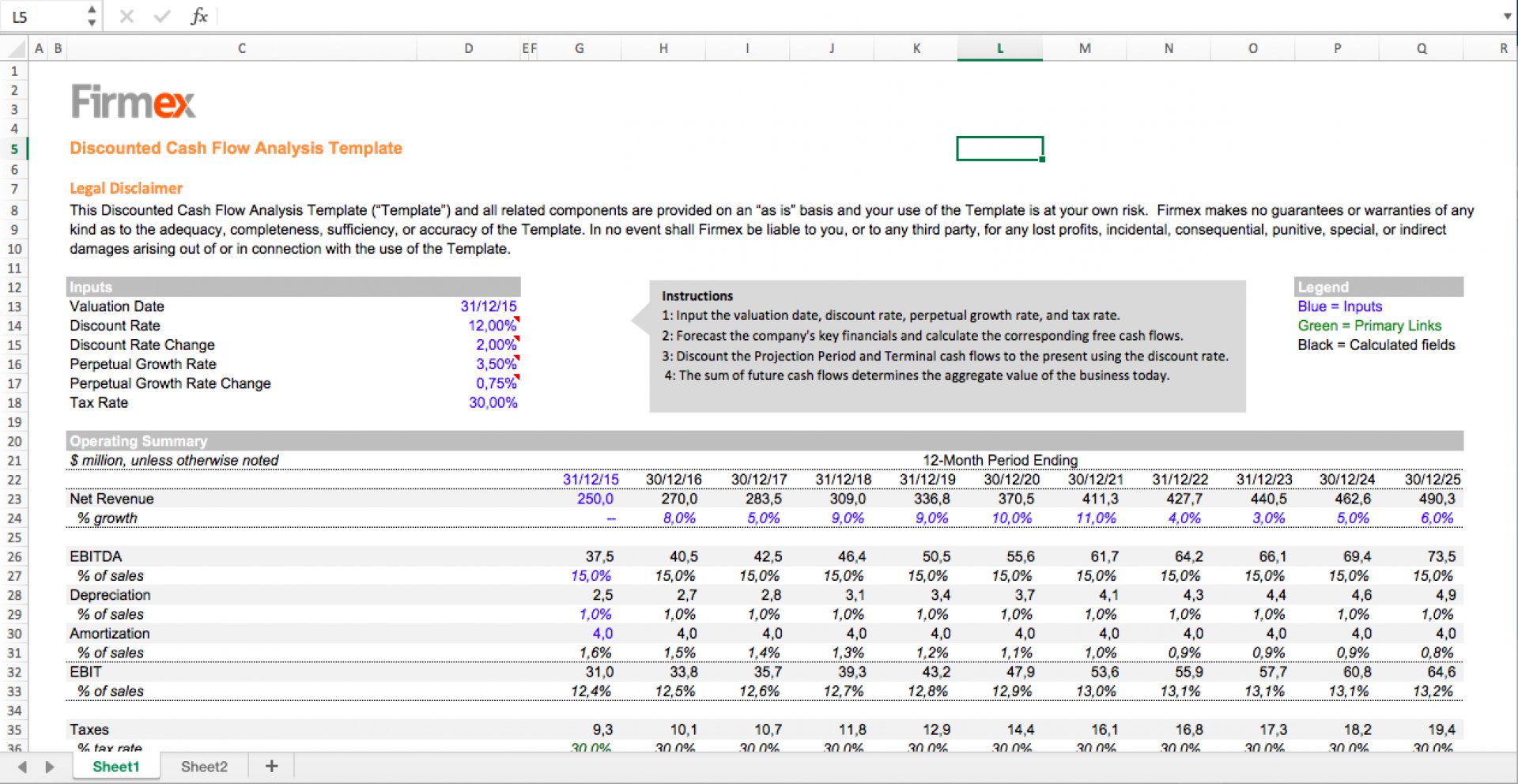

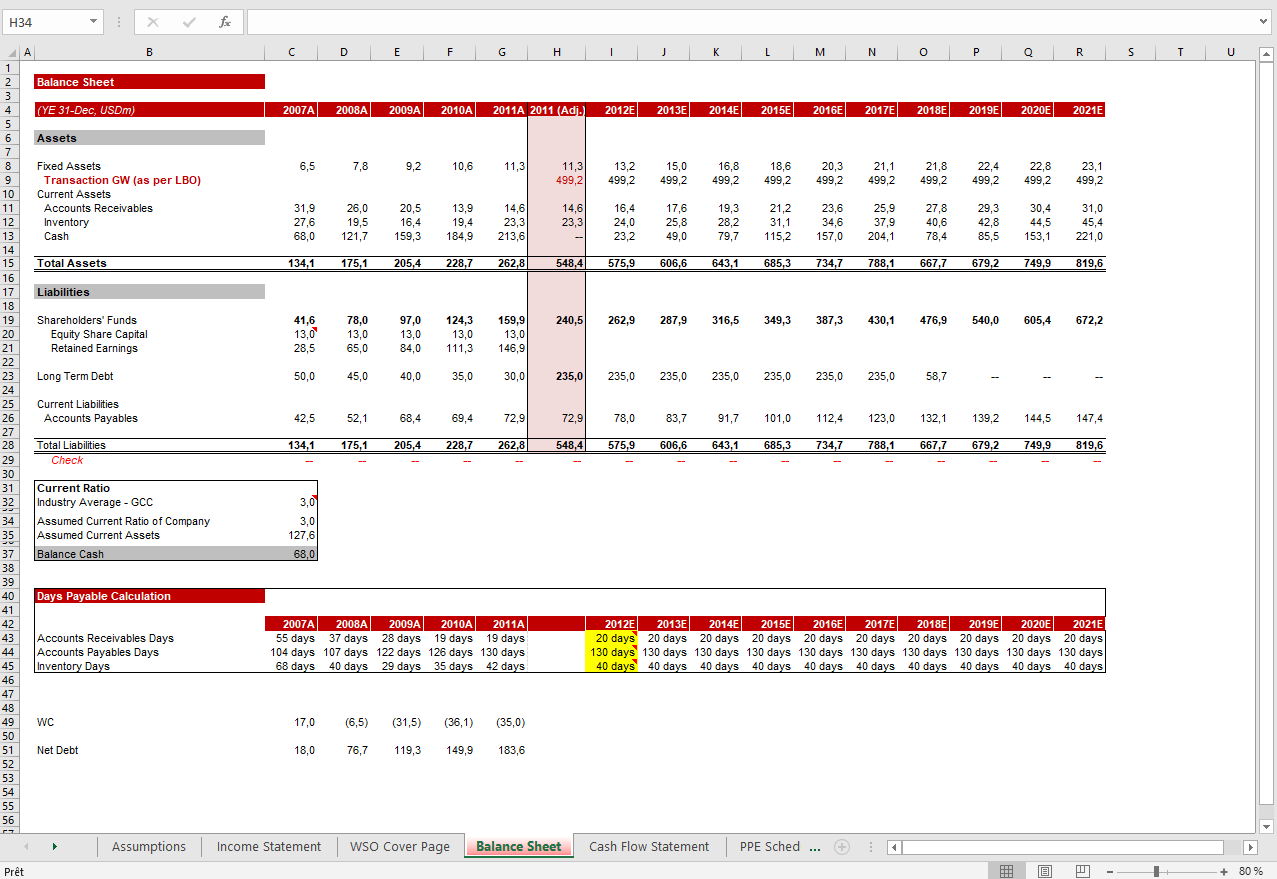

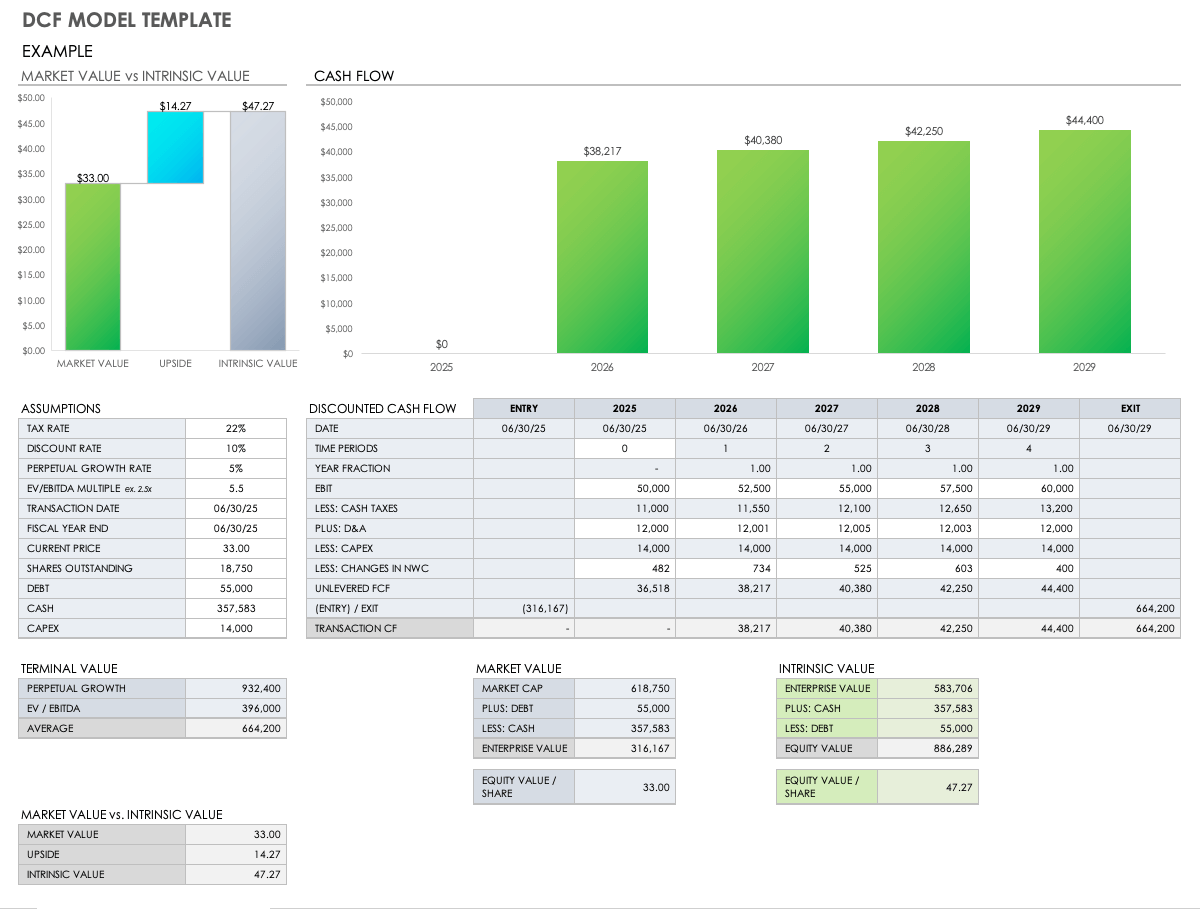

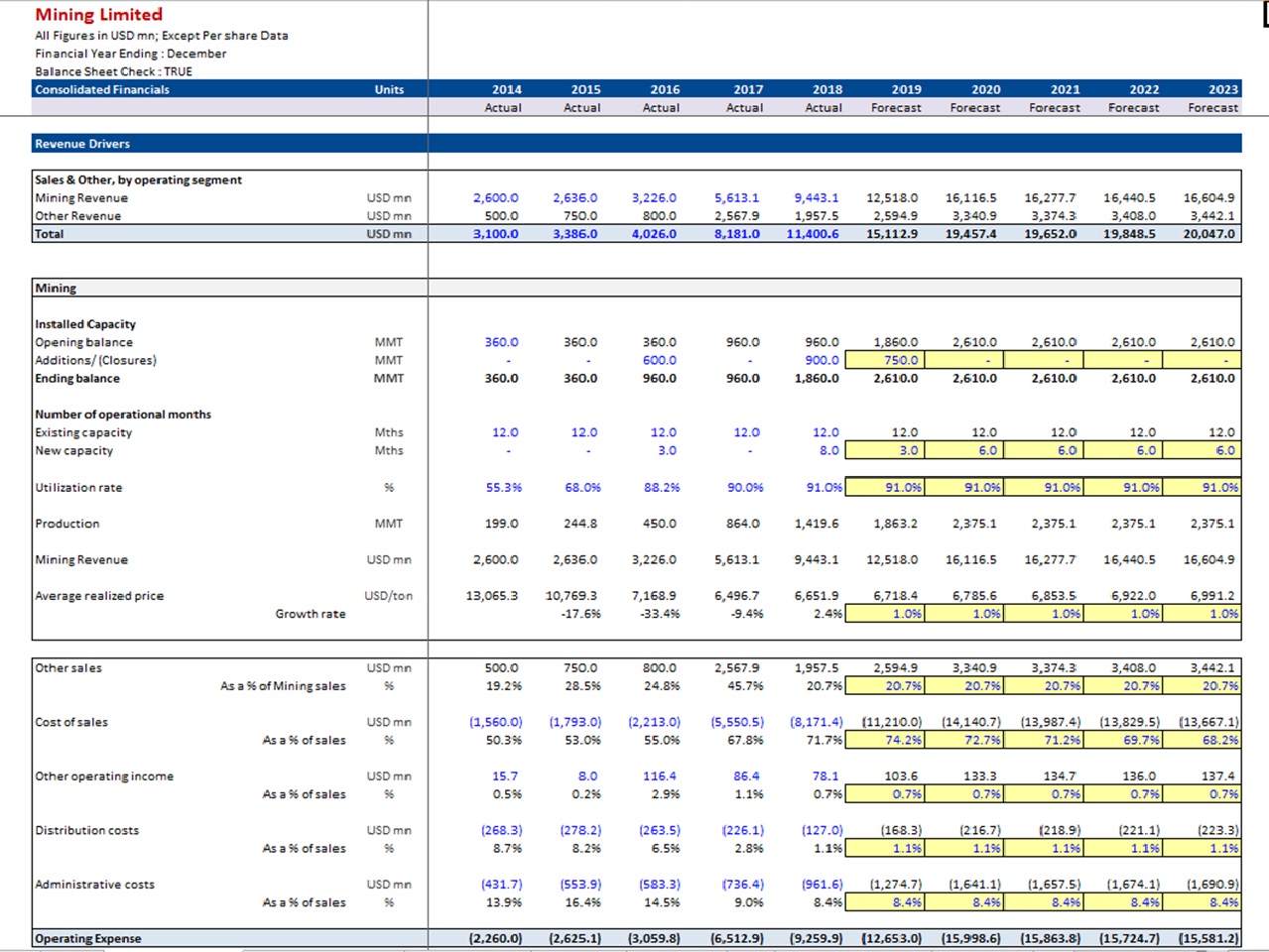

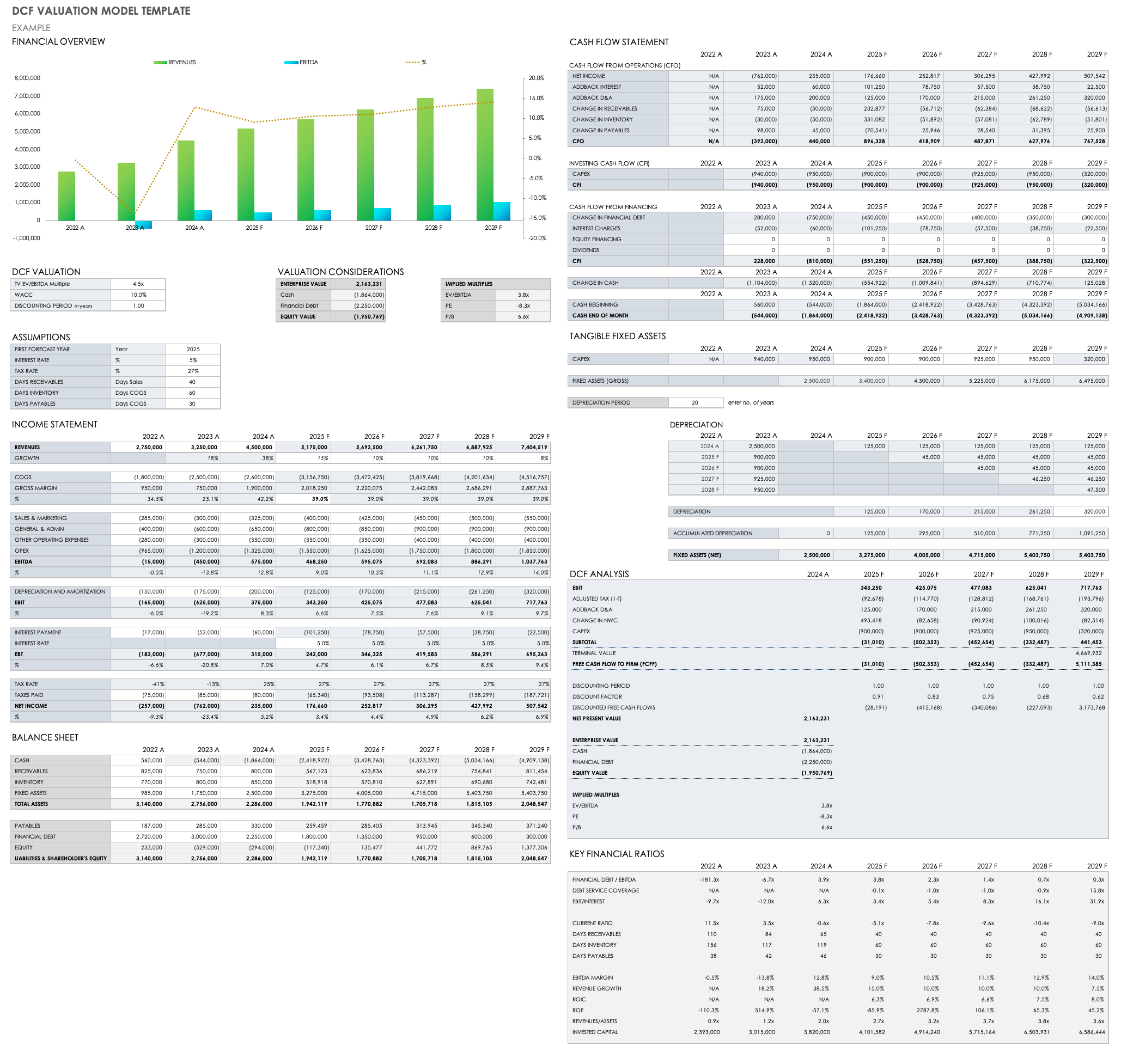

Discounted Cash Flow Model Template - Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow. The macabacus discounted cash flow template implements key concepts and best practices related to. Web discounted cash flow (dcf) excel model template. The discounted cash flow model is used to value companies in the present based on. Web the discounted cash flow dcf model template automatically calculates the rest for you. Web the discounted cash flow model. To do this, dcf finds the present value of future cash flows using a. Web click here to download the dcf template. Download wso's free discounted cash flow (dcf) model template below! Web discounted cash flow (dcf) is a method of valuing a project, company, or asset using the present value of future cash flows. * dashboard, * income statement, * cash. Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Download wso's free discounted cash flow (dcf) model template below!. Web the discounted cash flow model. Web discounted cash flow valuation model: Web what is a dcf model? Web to calculate fcf, locate the item cash flow from operations (also referred to as “operating cash” or “net cash from. This template allows you to build. Free excel template this discounted cash flow (dcf) valuation. Web to calculate fcf, locate the item cash flow from operations (also referred to as “operating cash” or “net cash from. Web the dcf model focuses on a company’s cash flows, determining the present value of the entire organization and then working. Web discounted cash flow (dcf) is an analysis method. Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n cf = the cash flow in a given year (cf1 is year one. Web. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. (ts) dcf excel template main parts of the financial model: Web the discounted cash flow model. Web the dcf. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by. Web the discounted cash flow model. (ts) dcf excel template main parts of the financial model: Web discounted cash flow template. The purpose of the discounted free cash flow financial. This template allows you to build. Web discounted cash flow valuation model: Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. You can also build and self. Web discounted cash flow (dcf) is a method of valuing a project, company, or asset using the present value of future. Web discounted cash flow (dcf) is a method of valuing a project, company, or asset using the present value of future cash flows. Web discounted cash flow template. Web the discounted cash flow (dcf) formula is equal to the sum of the cash flow in each period divided by one plus the. You can also build and self. Web the. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n cf = the cash flow in a given year (cf1 is year one. Free excel. Web to calculate fcf, locate the item cash flow from operations (also referred to as “operating cash” or “net cash from. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash. Web what is a dcf model? Web click here to download the dcf template. Web the discounted. Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web in the template below you can see the same projected cash flow for each year, and how a 10% cost of capital affects the value of. Web basic discounted cash flow formula: To do this, dcf finds the present value of future cash flows using a. The discounted cash flow (dcf) analysis represents the net present value (npv) of. Web discounted cash flow valuation model: Web discounted cash flow template. Web click here to download the dcf template. Web discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Web building a discounted cash flow model (dcf) model introduces some of the most critical aspects of finance including the time. Web discounted cash flow (dcf) excel model template. Web the discounted cash flow model. You can also build and self. The macabacus discounted cash flow template implements key concepts and best practices related to. * dashboard, * income statement, * cash flow, * balance. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by. Free excel template this discounted cash flow (dcf) valuation. This template allows you to build. The discounted cash flow model is used to value companies in the present based on. The purpose of the discounted free cash flow financial. Web discounted cash flow valuation model: Web to calculate fcf, locate the item cash flow from operations (also referred to as “operating cash” or “net cash from. Web what is a dcf model? Web discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. (ts) dcf excel template main parts of the financial model: Web the discounted cash flow method is used by professional investors and analysts at investment banks to determine how much. The discounted cash flow (dcf) analysis represents the net present value (npv) of. * dashboard, * income statement, * cash flow, * balance. The macabacus discounted cash flow template implements key concepts and best practices related to. Web dcf stands for discounted cash flow, so a dcf model is simply a forecast of a company’s unlevered free cash flow. Free excel template this discounted cash flow (dcf) valuation. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n cf = the cash flow in a given year (cf1 is year one. Video tutorial and excel templates if you’d prefer to watch rather than read, you can get this [very long] tutorial below: Web the discounted cash flow dcf model template automatically calculates the rest for you.DCF Discounted Cash Flow Model Excel Template Eloquens

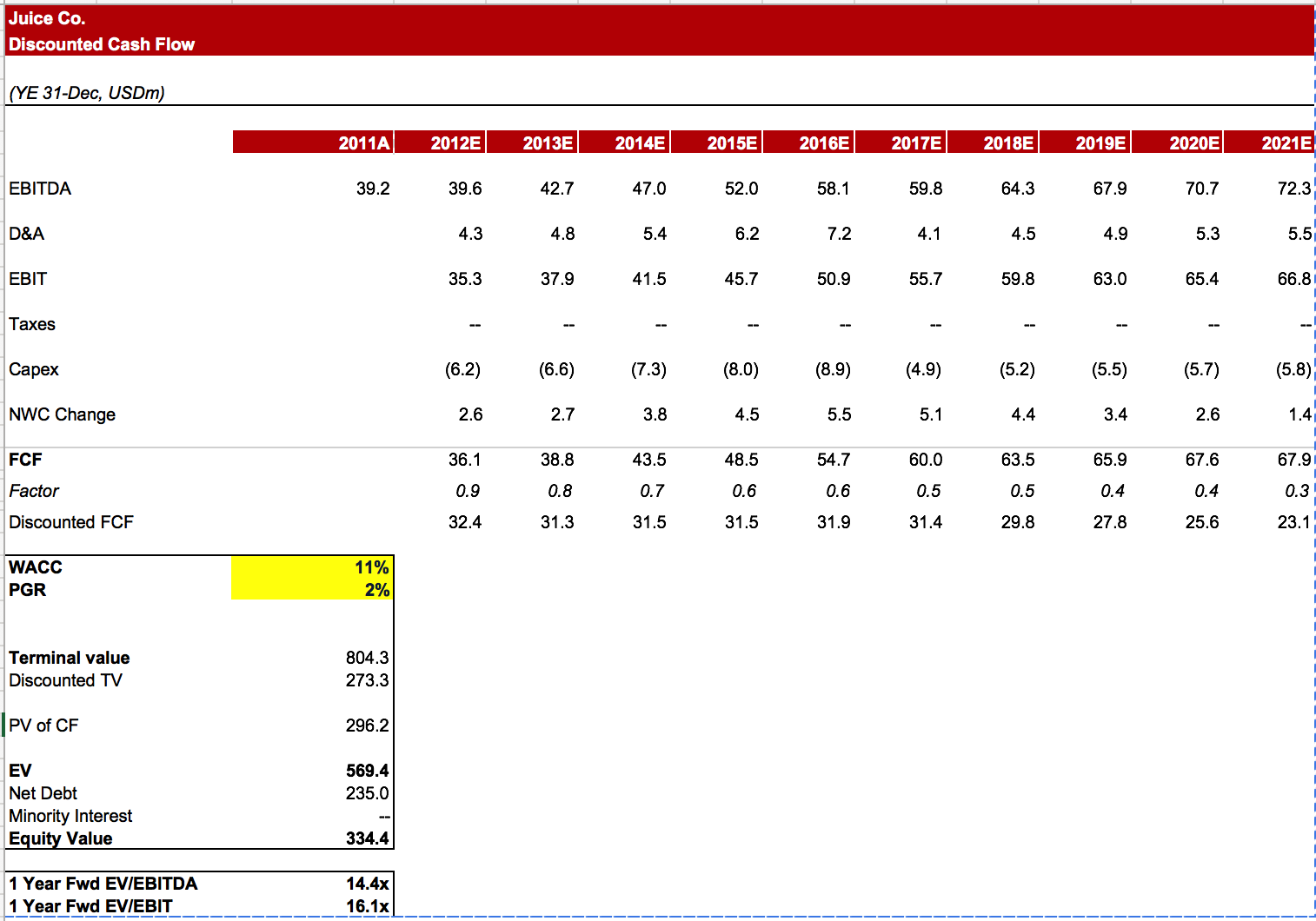

DCF Discounted Cash Flow Model Excel Template Eloquens

Discounted Cash Flow (DCF) Excel Model Template Eloquens

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow DCF Valuation Model Template (Mining Company

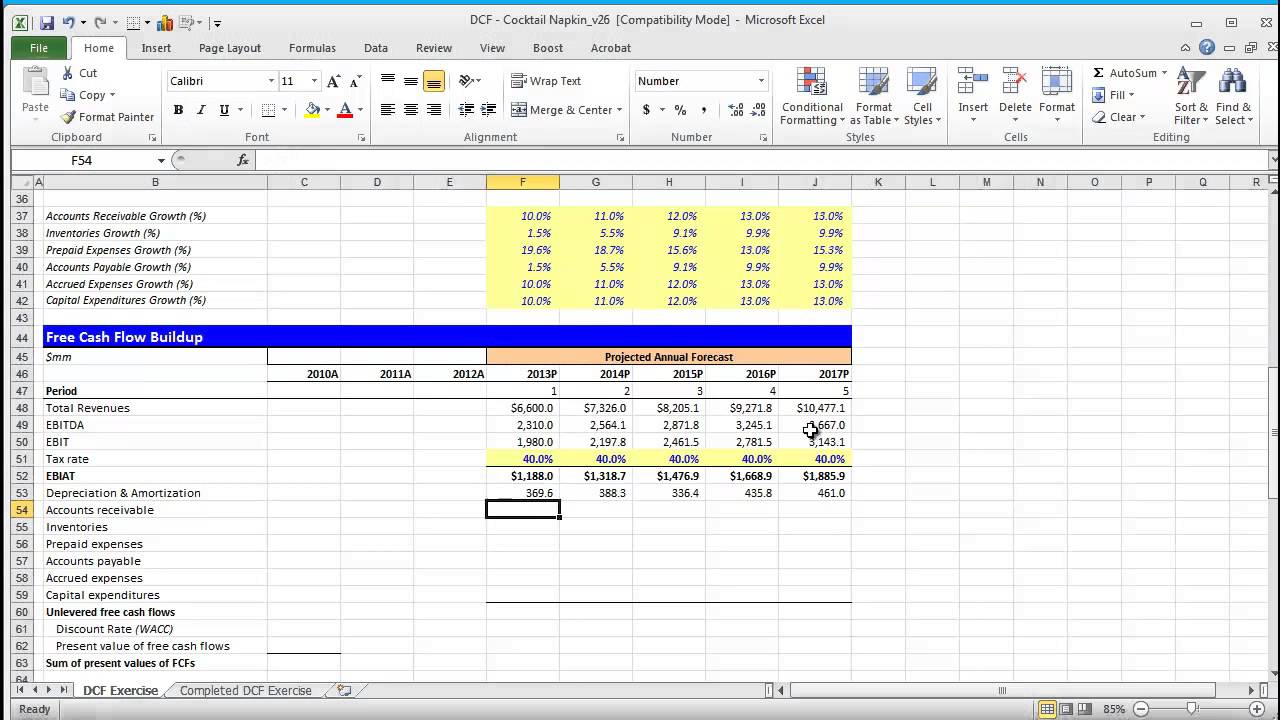

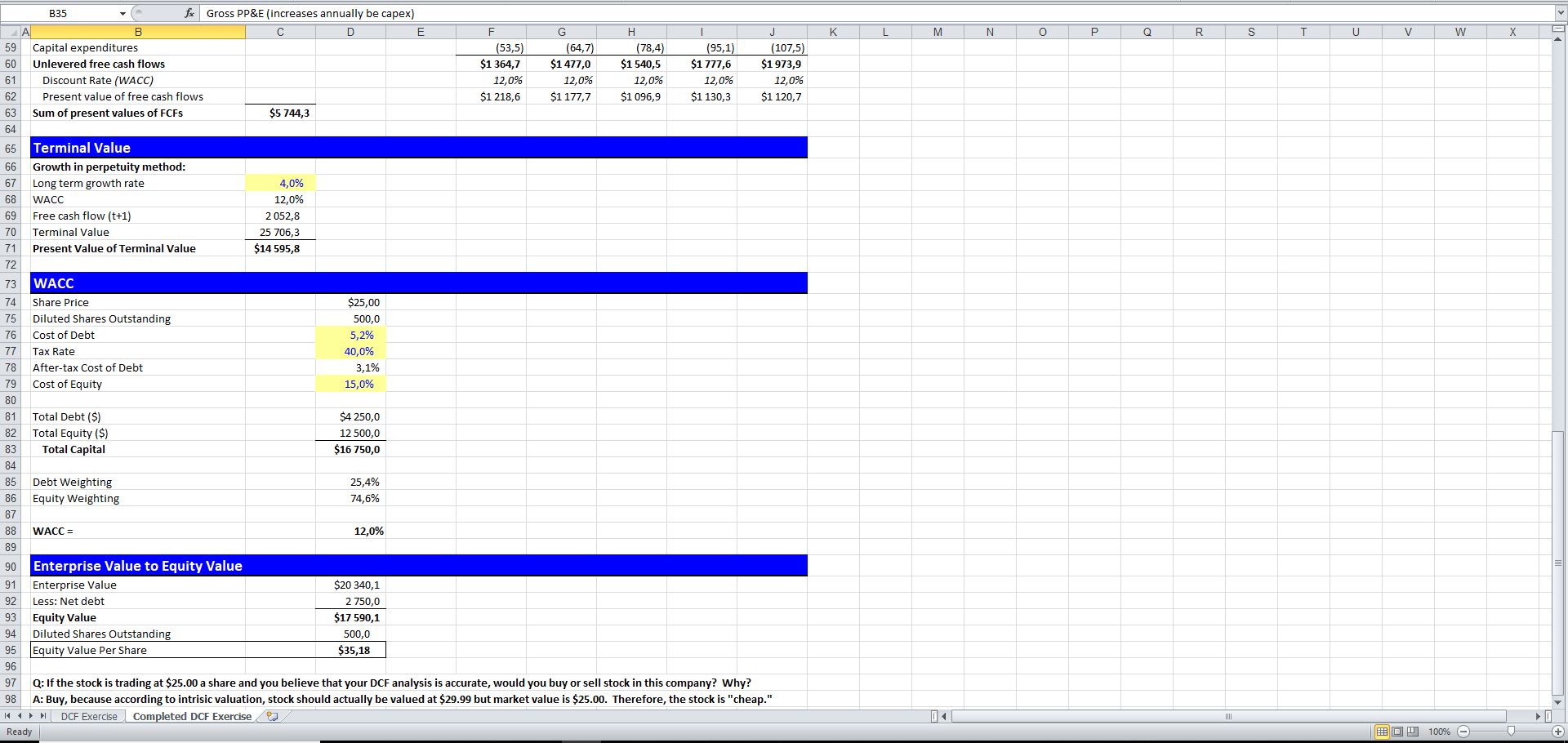

Financial Modeling Quick Lesson Building a Discounted Cash Flow (DCF

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

7 Cash Flow Analysis Template Excel Excel Templates

The Discounted Cash Flow Model, Or “Dcf Model”, Is A Type Of Financial Model That Values A Company By.

You Can Also Build And Self.

To Do This, Dcf Finds The Present Value Of Future Cash Flows Using A.

Web Click Here To Download The Dcf Template.

Related Post: