Dcf Model Template

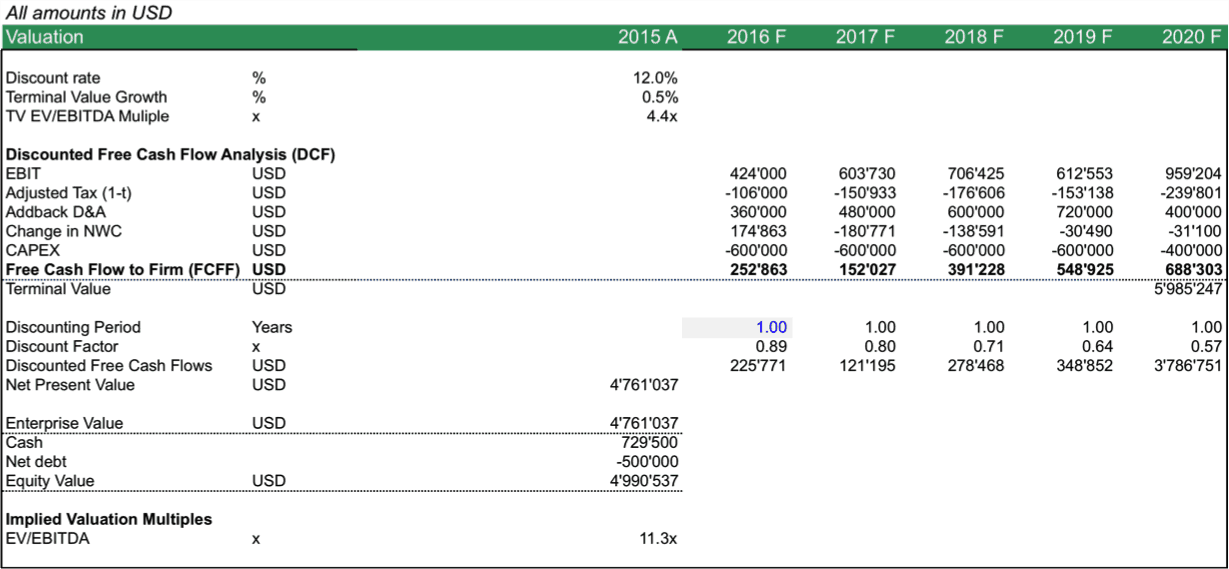

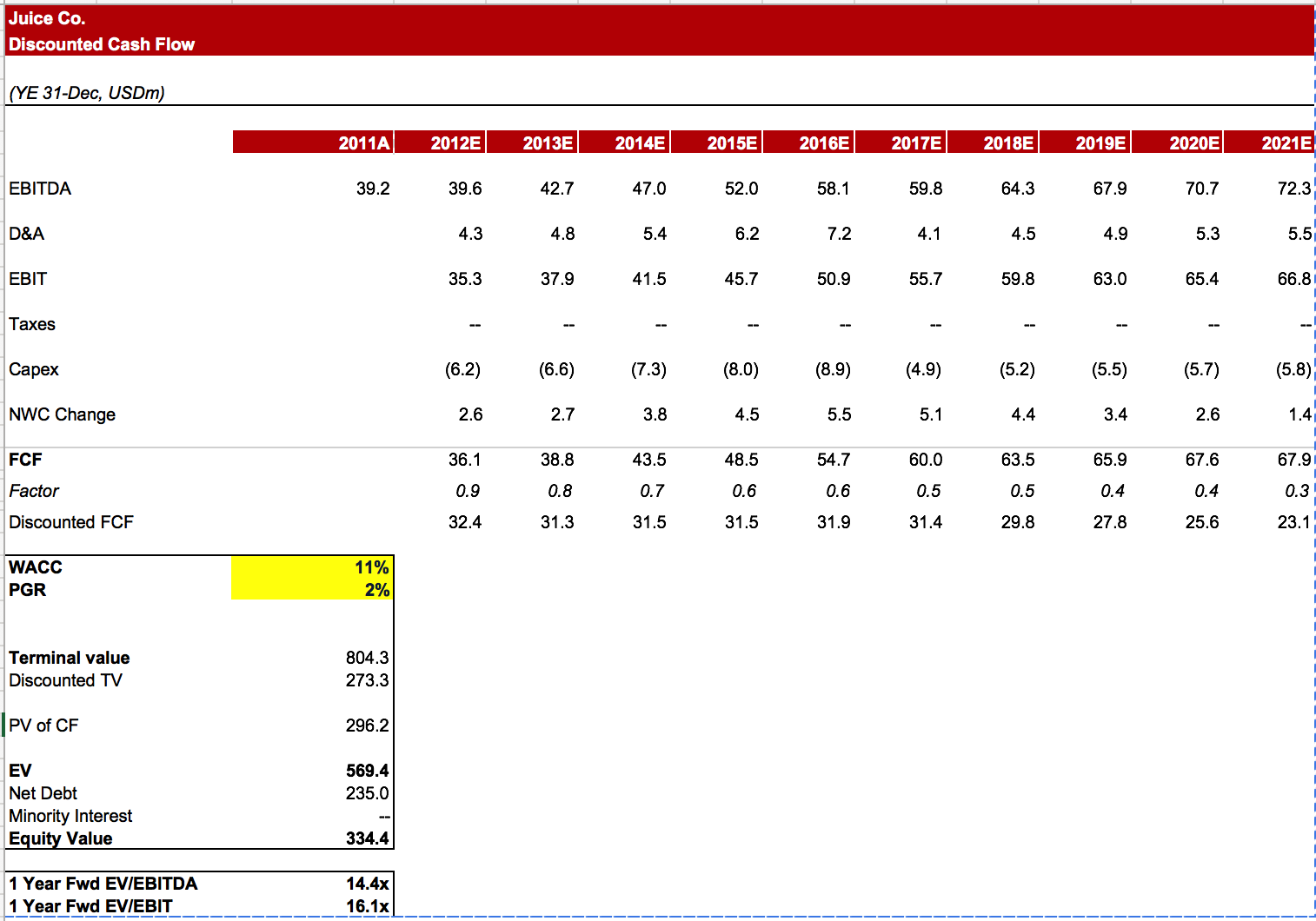

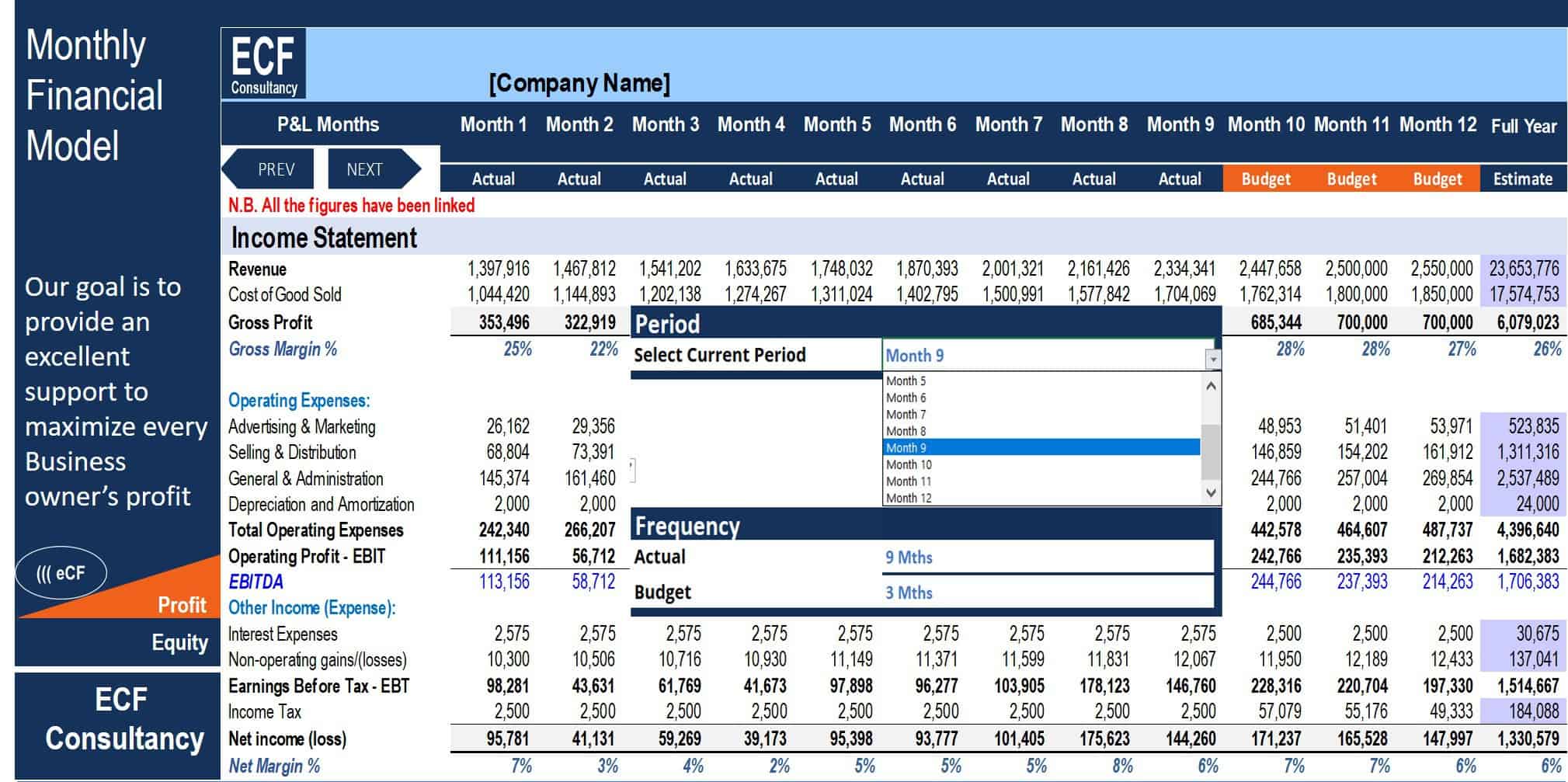

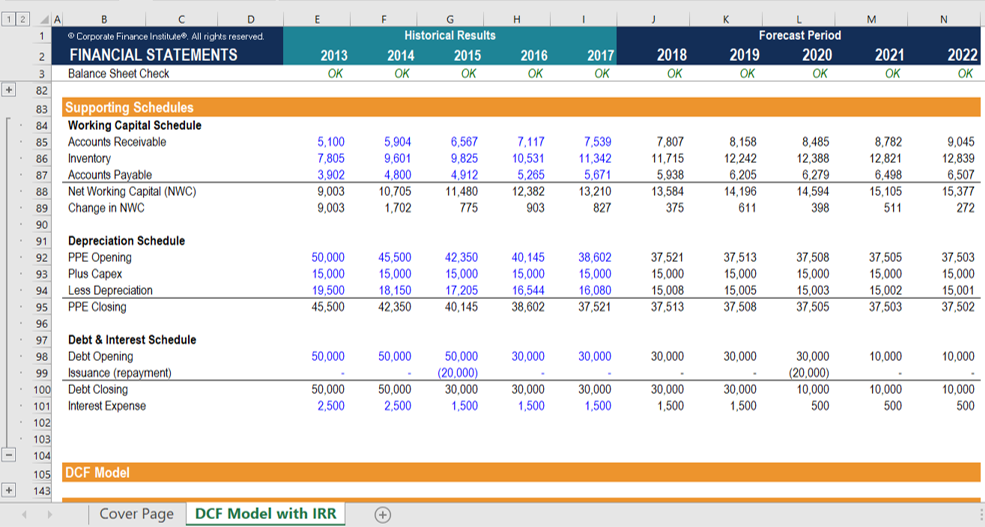

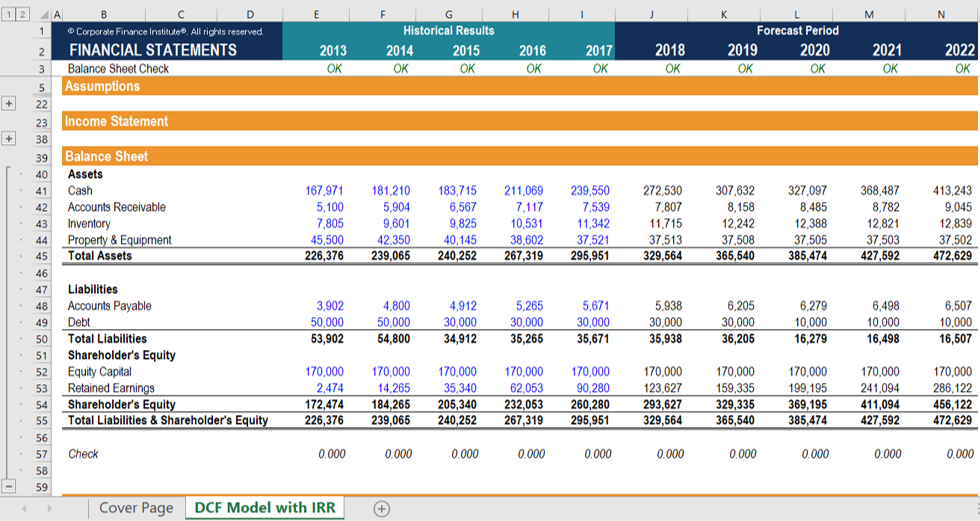

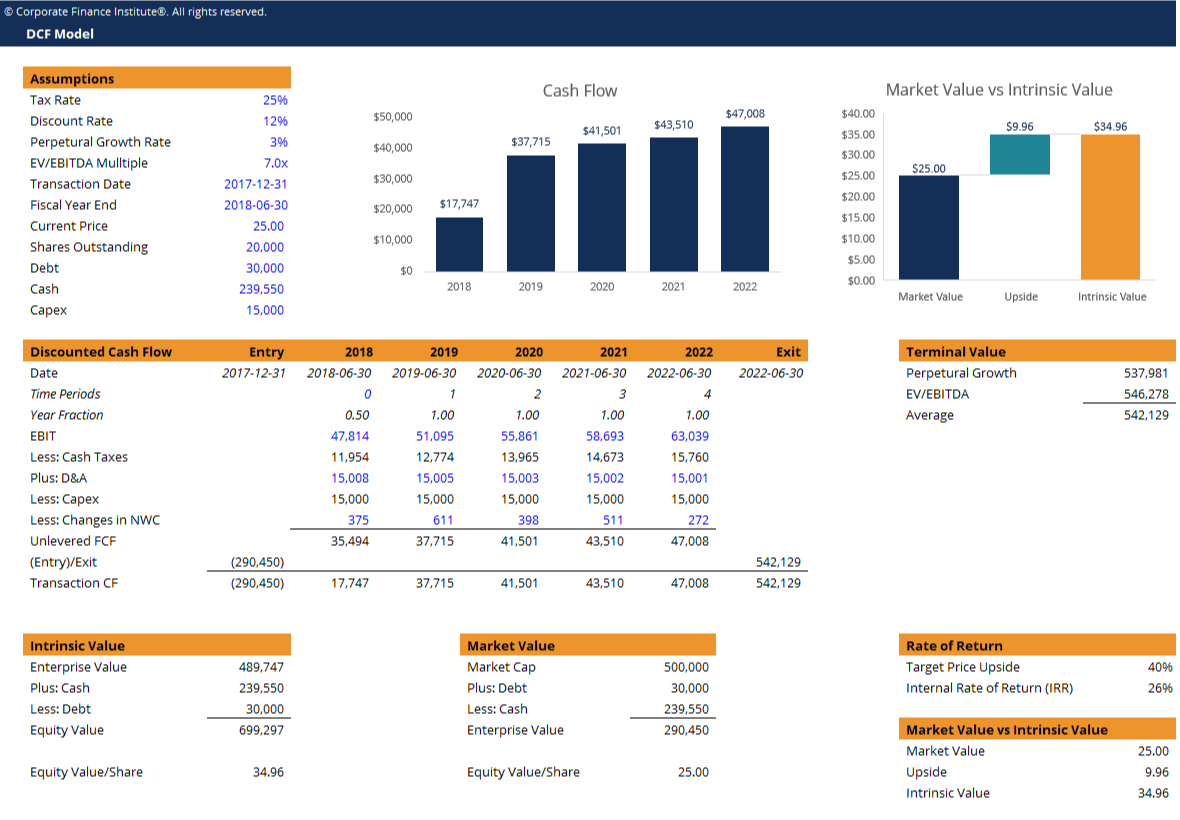

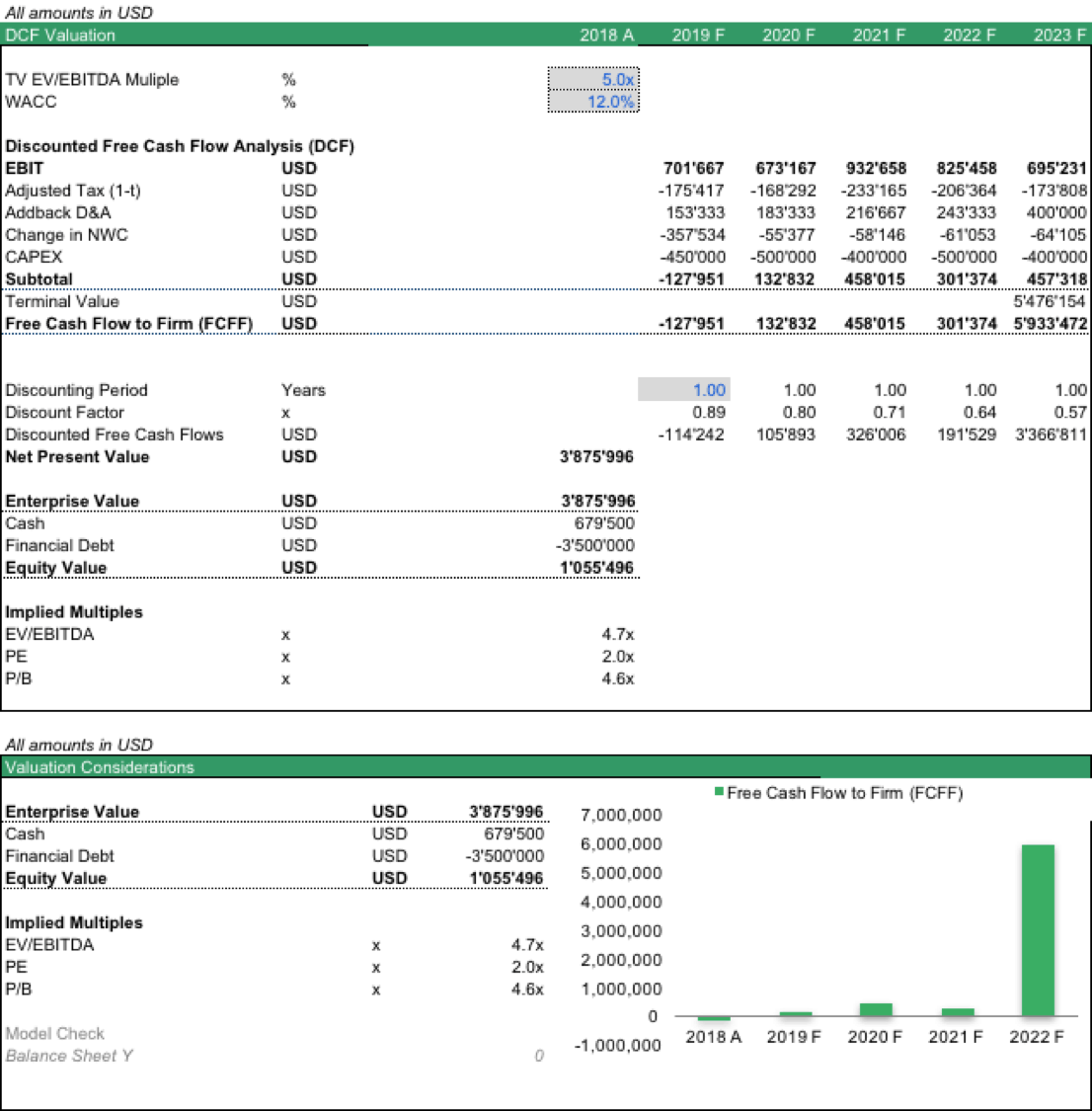

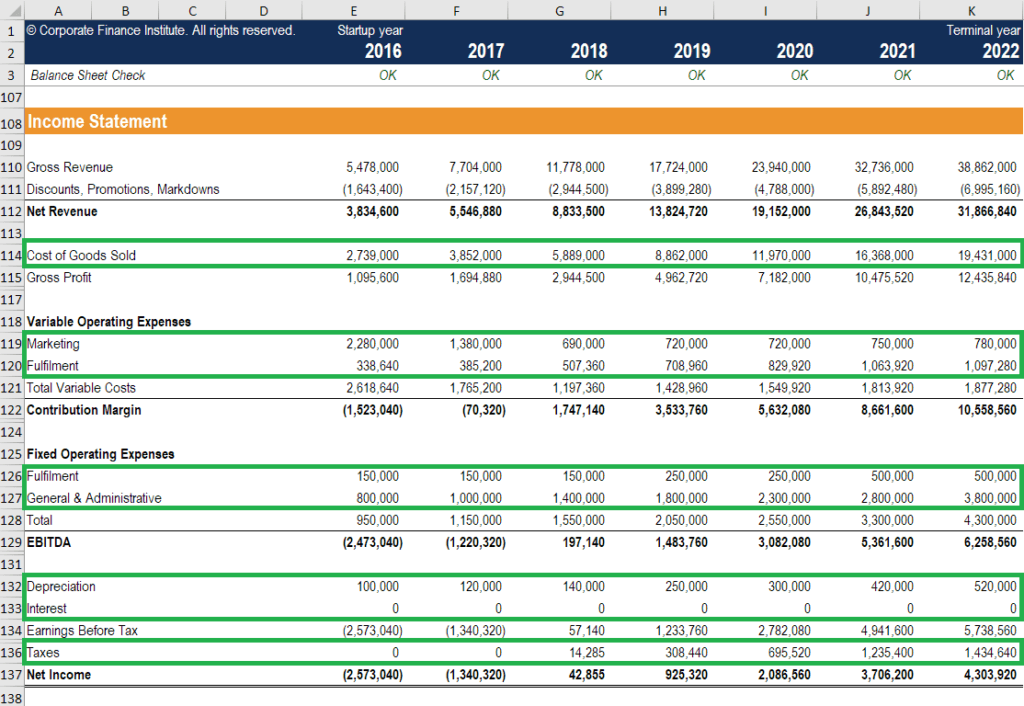

Dcf Model Template - Enter the assumptions on discount rate and terminal growth rate. Web what is the discounted cash flow dcf formula? Web financial modeling is the forecast of the company’s financial fundamentals based on its past and the expected future. Web discounted cash flow (dcf) model template + instructions. Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash. In the template model that you can download here,. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into. Download wso's free discounted cash flow (dcf) model template below! Discounted cash flow (dcf) is a method used to estimate the value of an. The discounted free cash flow (dcf) method is a widely. Web use the form below to download our sample dcf model template: April 12, 2022 discounted cash flow (dcf) is a method. Web discounted cash flow (dcf) model template + instructions. Discounted cash flow (dcf) is a method used to estimate the value of an. Web dcf model template with irr this dcf model template from cfi is an effective. Enter the assumptions on discount rate and terminal growth rate. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into. In the template model that you can download here,. This template allows you to build. Learn more a few modules are dedicated to valuation and dcf analysis, and there. April 12, 2022 discounted cash flow (dcf) is a method. Web what is the discounted cash flow dcf formula? Web financial modeling is the forecast of the company’s financial fundamentals based on its past and the expected future. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into. Web. Learn how to build a simple dcf model aligned with. Download wso's free discounted cash flow (dcf) model template below! By cfi financial modeling competition & world championships follow 44 1,178 views | start the discussion! How to build a dcf model: Enter the net income, change in. The macabacus discounted cash flow template implements key concepts and best practices related to. This dcf model template helps you: April 12, 2022 discounted cash flow (dcf) is a method. Learn how to build a simple dcf model aligned with. In the template model that you can download here,. Web use the form below to download our sample dcf model template: April 12, 2022 discounted cash flow (dcf) is a method. Web discounted cash flow template. The purpose of the discounted free cash flow financial. The discounted free cash flow (dcf) method is a widely. Web enter your name and email in the form below and download the free dcf model excel template now! Enter the net income, change in. Web use the form below to download our sample dcf model template: Discounted cash flow (dcf) is a method used to estimate the value of an. Web discounted cash flow (dcf) refers to a valuation. April 12, 2022 discounted cash flow (dcf) is a method. Enter the net income, change in. Learn how to build a simple dcf model aligned with. The purpose of the discounted free cash flow financial. The discounted cash flow (dcf) formula is equal to the sum of the. By cfi financial modeling competition & world championships follow 44 1,178 views | start the discussion! In the template model that you can download here,. What is discounted cash flow? Web what is the discounted cash flow dcf formula? Web use the form below to download our sample dcf model template: What is discounted cash flow? Web what is the discounted cash flow dcf formula? The template uses the discounted cash flow (dcf) method, which discounts future cash flows back to present value. Web discounted cash flow template. The purpose of the discounted free cash flow financial. The discounted cash flow (dcf) formula is equal to the sum of the. How to build a dcf model: Web enter your name and email in the form below and download the free dcf model excel template now! The template uses the discounted cash flow (dcf) method, which discounts future cash flows back to present value. The discounted free cash flow (dcf) method is a widely. Download wso's free discounted cash flow (dcf) model template below! Web what is the discounted cash flow dcf formula? April 12, 2022 discounted cash flow (dcf) is a method. Learn how to build a simple dcf model aligned with. By cfi financial modeling competition & world championships follow 44 1,178 views | start the discussion! Web the dcf model calculates the present value of the business future cash flows. The purpose of the discounted free cash flow financial. Web discounted cash flow (dcf) excel template updated: What is discounted cash flow? Learn more a few modules are dedicated to valuation and dcf analysis, and there are example company valuations in other industries. This template allows you to build. The macabacus discounted cash flow template implements key concepts and best practices related to. In the template model that you can download here,. Web discounted cash flow (dcf) model template + instructions. Web financial modeling is the forecast of the company’s financial fundamentals based on its past and the expected future. Web discounted cash flow (dcf) excel model template. The discounted cash flow (dcf) formula is equal to the sum of the. How to build a dcf model: Enter the assumptions on discount rate and terminal growth rate. Web financial modeling is the forecast of the company’s financial fundamentals based on its past and the expected future. Web the discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into. Web enter your name and email in the form below and download the free dcf model excel template now! This template allows you to build. Web use the form below to download our sample dcf model template: Web the dcf model calculates the present value of the business future cash flows. Enter the net income, change in. Discounted cash flow (dcf) is a method used to estimate the value of an. Web what is the discounted cash flow dcf formula? Web discounted cash flow (dcf) refers to a valuation method that estimates the value of an investment using its expected future cash. Learn how to build a simple dcf model aligned with. Learn more a few modules are dedicated to valuation and dcf analysis, and there are example company valuations in other industries.DCF Model eFinancialModels

Discounted Cash Flow (DCF) Model Template Wall Street Oasis

Financial Model Template Package 12+ Models, DCF, LBO, M&A

DCF Model Templates eFinancialModels

DCF Model Template with IRR Eloquens

DCF Model Template with IRR Eloquens

DCF Valuation Model Template Eloquens

How to Build DCF Model Excel Training Guide

Trending Dcf Formula Excel Pics Formulas

DCF Model Training The Ultimate Free Guide to DCF Models

What Is Discounted Cash Flow?

Download Wso's Free Discounted Cash Flow (Dcf) Model Template Below!

Web Discounted Cash Flow (Dcf) Model Template + Instructions.

The Discounted Free Cash Flow (Dcf) Method Is A Widely.

Related Post: