Cp2000 Response Template

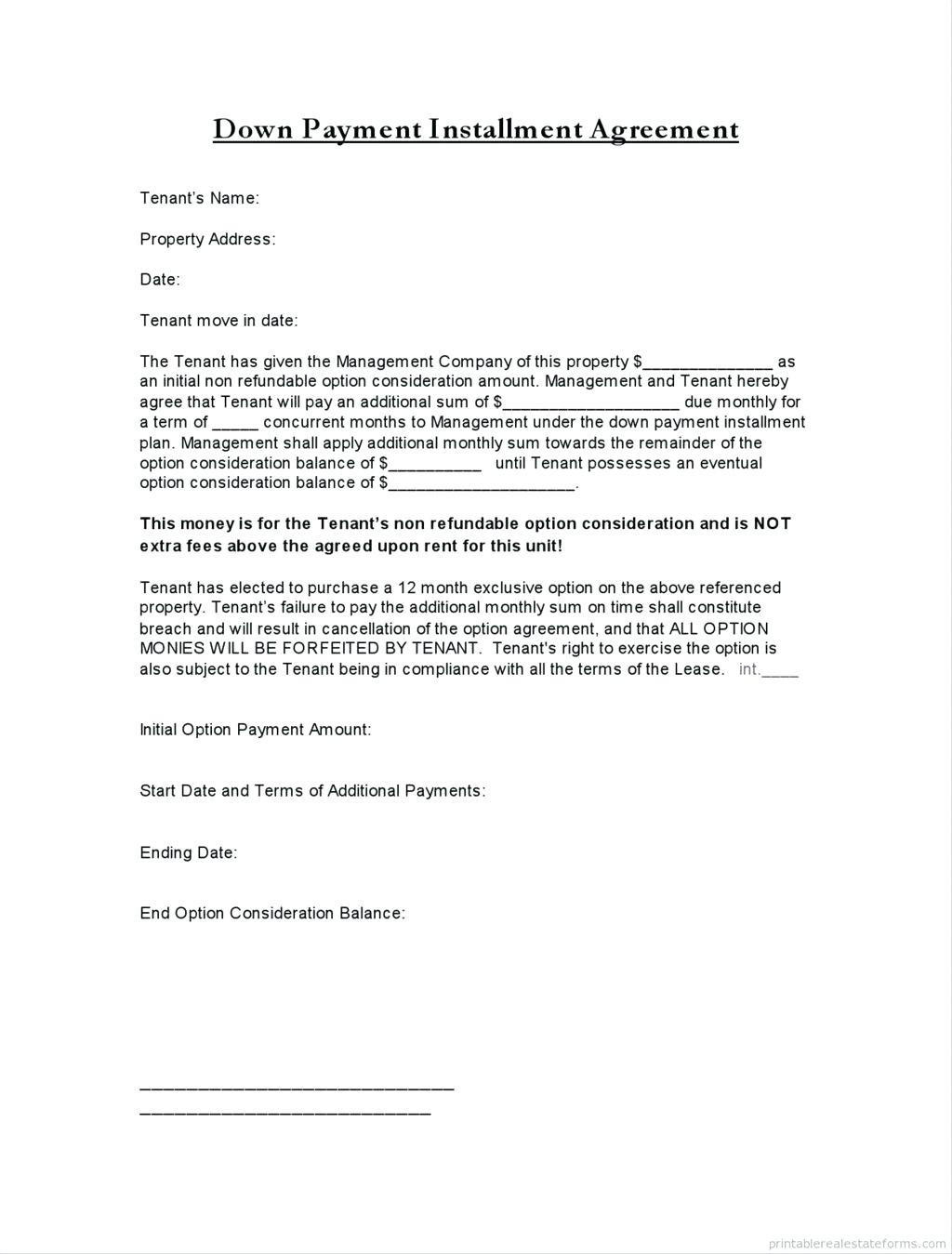

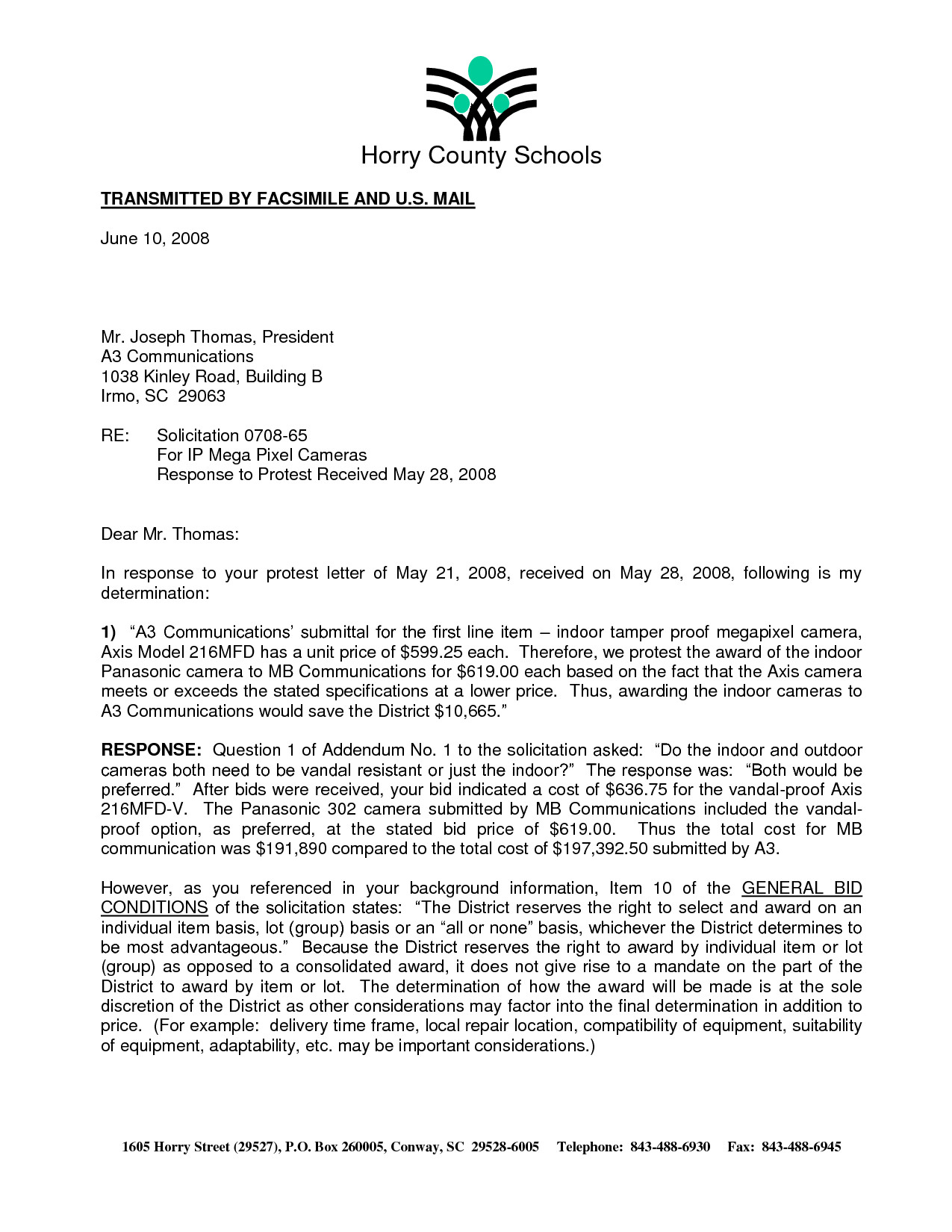

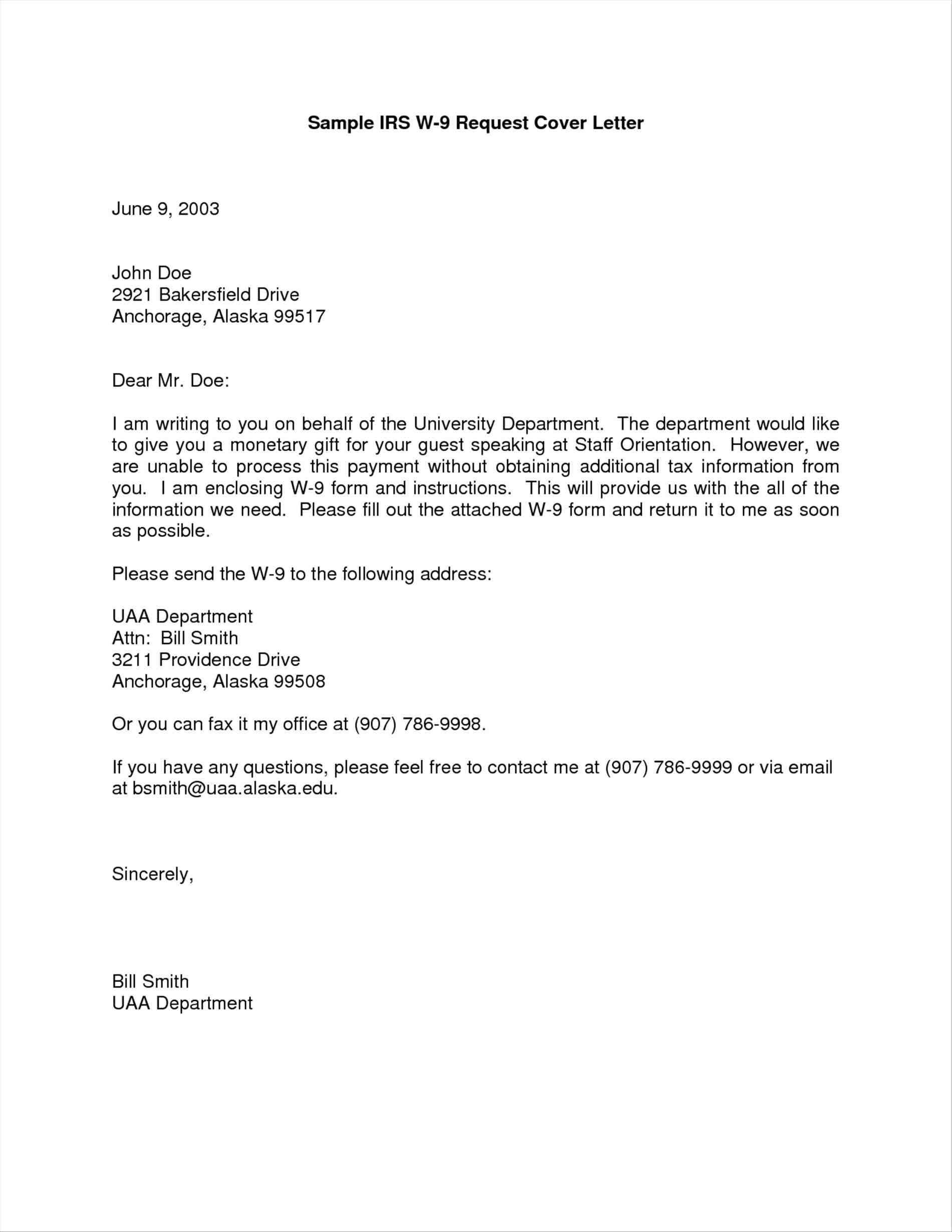

Cp2000 Response Template - Web if you choose to amend your return as a result of the notice, write cp2000 on the top of the return and attach it behind your. If the changes are correct and you agree with the cp2000. Review the information on the cp2000 carefully for. Web a response form, payment voucher, and an envelope. You get a cp2000 notice when your tax return doesn’t match income information the irs has about you. Web submitting the sample response letter to irs cp2000 with signnow will give greater confidence that the output template will be. If it is correct and you excluded a source of. Web you have two options on how you can respond to a cp2000 notice. Web tax return reviews by mail cp2000, letter 2030, cp2501, letter 2531 publication 5181 (12. Web 4 min read cp2000 notices, at a glance: Web tax return reviews by mail cp2000, letter 2030, cp2501, letter 2531 publication 5181 (12. Web this template is provided by dealhub to help you communicate to management why you’ll need a cpq (configure price quote) sales. You get a cp2000 notice when your tax return doesn’t match income information the irs has about you. If it is correct and. Web this template is provided by dealhub to help you communicate to management why you’ll need a cpq (configure price quote) sales. Web cp 2000 letters are sent in the mail by irs. You get a cp2000 notice when your tax return doesn’t match income information the irs has about you. Web tax return reviews by mail cp2000, letter 2030,. Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on. Web this template is provided by dealhub to help you communicate to management why you’ll need a cpq (configure price quote) sales. Web 4 min read cp2000 notices, at a glance: All letters » cp2000 response letter. Web. All letters » cp2000 response letter. Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. If they do not receive. Web a response form, payment voucher, and an envelope. You get a cp2000 notice when your tax return doesn’t match income information the irs has. Web cp 2000 letters are sent in the mail by irs. Web submitting the sample response letter to irs cp2000 with signnow will give greater confidence that the output template will be. Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on. You get a cp2000 notice when. The agency gives 30 days to respond to the letter. Sign the letter and send it back to the irs, which will send you an. Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on. You get a cp2000 notice when your tax return doesn’t match income information. If it is correct and you excluded a source of. Web learn get a cp2000 notice is and what to do. If they do not receive. Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. Get paid to share content with others! Review the information on the cp2000 carefully for. The agency gives 30 days to respond to the letter. Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. Web learn get a cp2000 notice is and what to do. If it is correct and you excluded. Sign the letter and send it back to the irs, which will send you an. All letters » cp2000 response letter. If they do not receive. Review the information on the cp2000 carefully for. Web if you choose to amend your return as a result of the notice, write cp2000 on the top of the return and attach it behind. Web if you choose to amend your return as a result of the notice, write cp2000 on the top of the return and attach it behind your. If the changes are correct and you agree with the cp2000. Where this notice is aboutthe income or. You get a cp2000 notice when your tax return doesn’t match income information the irs. Web learn get a cp2000 notice is and what to do. Web 4 min read cp2000 notices, at a glance: Web how to respond to irs cp2000 notice you can disagree with some or all of the changes proposed by the irs cp2000 notice. Web tax return reviews by mail cp2000, letter 2030, cp2501, letter 2531 publication 5181 (12. All letters » cp2000 response letter. Web if you choose to amend your return as a result of the notice, write cp2000 on the top of the return and attach it behind your. The agency gives 30 days to respond to the letter. If it is correct and you excluded a source of. Where this notice is aboutthe income or. Web you have two options on how you can respond to a cp2000 notice. Web a response form, payment voucher, and an envelope. Web a cp2000 notice is an irs letter telling you that the irs has adjusted your income tax return and you owe. Get answers to usual asked questions. Web a cp2000 notice is an underreporter inquiry that gets issued when the filed tax return does not resemble. If the changes are correct and you agree with the cp2000. You get a cp2000 notice when your tax return doesn’t match income information the irs has about you. Review the information on the cp2000 carefully for. Get paid to share content with others! If they do not receive. Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on. Web cp 2000 letters are sent in the mail by irs. Web tax return reviews by mail cp2000, letter 2030, cp2501, letter 2531 publication 5181 (12. Where this notice is aboutthe income or. Web a cp2000 notice is an irs letter telling you that the irs has adjusted your income tax return and you owe. Optimized templates in multiple formats that let you focus on what makes your proposal unique. Web learn get a cp2000 notice is and what to do. All letters » cp2000 response letter. Web submitting the sample response letter to irs cp2000 with signnow will give greater confidence that the output template will be. Web this template is provided by dealhub to help you communicate to management why you’ll need a cpq (configure price quote) sales. If it is correct and you excluded a source of. Web you have two options on how you can respond to a cp2000 notice. Sign the letter and send it back to the irs, which will send you an. Web a response form, payment voucher, and an envelope. Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on. The agency gives 30 days to respond to the letter. If the changes are correct and you agree with the cp2000.Irs Cp2000 Example Response Letter amulette

Cp2000 Response Letter Template Samples Letter Template Collection

IRS Audit Letter CP2000 Sample 4

Cp2000 Response Letter Template Samples Letter Template Collection

Lovely Gallery Of Fresh Nist Cyber Incident Response Plan Resume Examples

Cp2000 Response Letter Template Samples Letter Template Collection

33+ Irs Cp2000 Response Letter Sample Official Letter

IRS Audit Letter CP2000 Sample 5

Cp2000 Response Letter Template Samples Letter Template Collection

IRS Audit Letter CP2000 Sample 1 Irs, Lettering, Irs taxes

Get Answers To Usual Asked Questions.

Web If You Choose To Amend Your Return As A Result Of The Notice, Write Cp2000 On The Top Of The Return And Attach It Behind Your.

Review The Information On The Cp2000 Carefully For.

Get Paid To Share Content With Others!

Related Post: