Cost Of Goods Sold Template

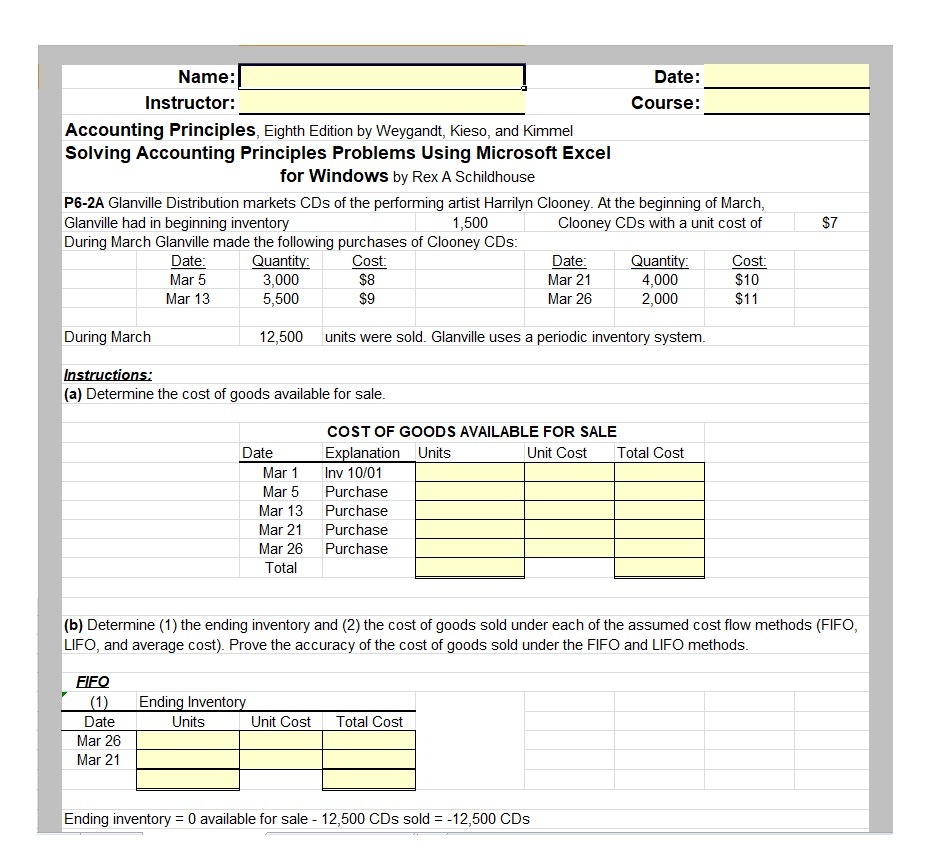

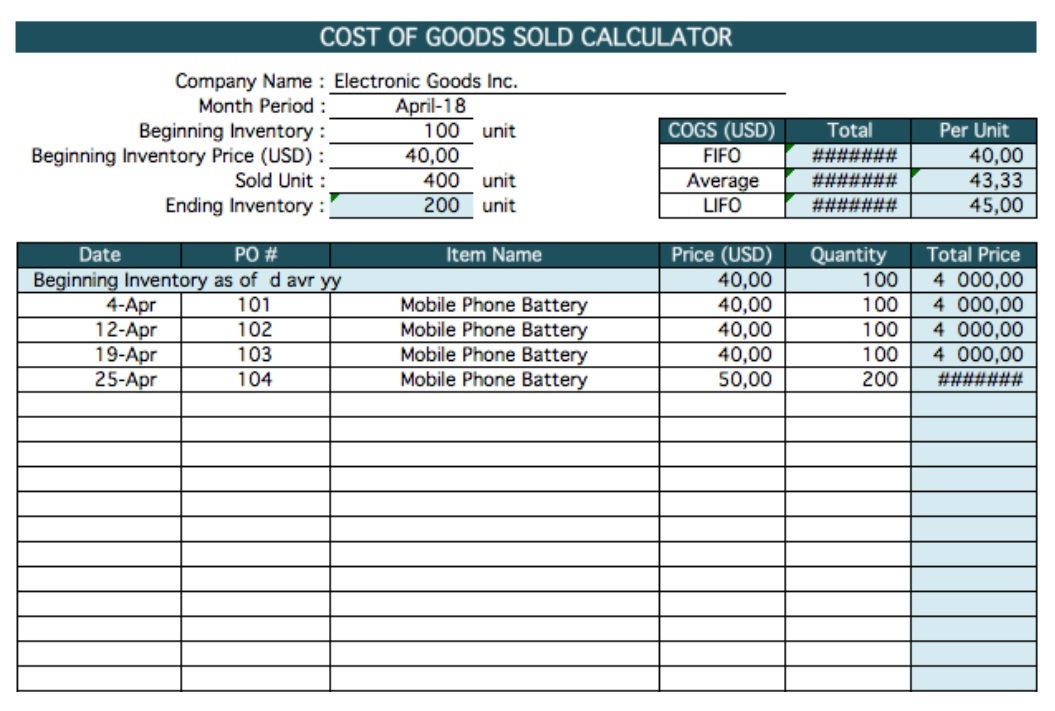

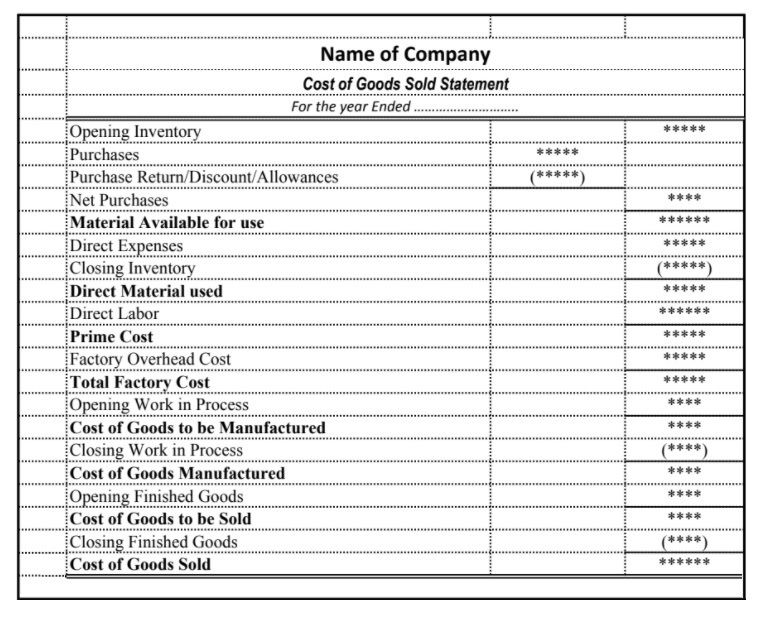

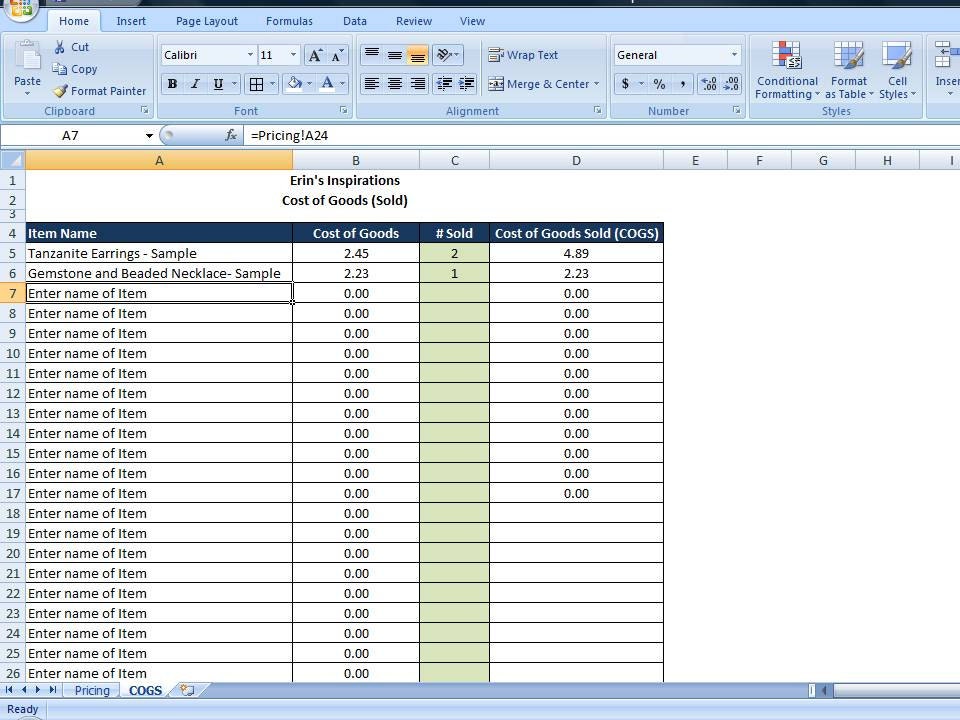

Cost Of Goods Sold Template - Watch on what is included in cost of goods sold? Web download this template and start using it today. Web cost of goods sold (cogs) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the. This easy to use workbook will help you with cogs calculations for the cost of. Web the cost of goods (cog) forecast template and spreadsheet include categories for five types of your products and services, with. Purchases are the total cost incurred from manufacturing to transporting goods and services. Web cost of goods sold (cogs) is the carrying value of goods sold during a particular period. Web cogs template you can download below is based on that merchandising companies model. Return and allowances are deducted while calculating the cost of goods sold as they are returned to the customers. This figure tells anyone reviewing the. Return and allowances are deducted while calculating the cost of goods sold as they are returned to the customers. Web cost of goods sold (cogs) is the cost of a product to a distributor, manufacturer or retailer. Cogs includes all direct costs incurred to create. Cogs = (starting inventory + purchases made during the. Web cost of goods sold sheet. Watch on what is included in cost of goods sold? Return and allowances are deducted while calculating the cost of goods sold as they are returned to the customers. Cost of goods sold = $51,000; Web cost of goods sold formula. Web cost of goods sold (cogs) refers to the direct costs associated with producing your product or service. Web cost of goods sold is the total cost a business has paid out of pocket to sell a product or service. Web cost of goods sold (cogs) is the cost of a product to a distributor, manufacturer or retailer. Cost of goods sold (or cogs) is the sum of direct expenses. Costs are associated with particular goods. Purchases are. Cogs includes all direct costs incurred to create. Web the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. Web cost of goods sold sheet template posted bydruvisnovember 14, 2019 cost of goods sold is amount paid by. Web cost of goods sold (cogs) refers to the direct costs associated. Web cost of goods sold (cogs) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the. Web cost of goods sold, commonly referred to as cogs, is the sum of costs directly associated with producing the goods sold. Web download this cost of goods sold (cogs) template. This figure includes materials and labor costs,. Cost of goods sold = $51,000; Return and allowances are deducted while calculating the cost of goods sold as they are returned to the customers. Web download this template and start using it today. Web cost of goods sold (cogs) is the cost of acquiring or manufacturing the products that a company sells. Cost of goods sold (or cogs) is the sum of direct expenses. Costs are associated with particular goods. Web cost of goods sold is the accounting term used to describe the expenses incurred to produce the goods or. Web cost of goods sold is the total cost a business has paid out of pocket to sell a product or service.. Web packaging also makes goods look appealing for sale and may display a company’s logo or brand. Purchases are the total cost incurred from manufacturing to transporting goods and services. This figure includes materials and labor costs,. This easy to use workbook will help you with cogs calculations for the cost of. The cost of goods sold by the company. Purchases are the total cost incurred from manufacturing to transporting goods and services. Web cost of goods sold is the total cost a business has paid out of pocket to sell a product or service. Enter the cost of goods sold by your company. Web cost of goods sold. In the income statement for a business one of the key. Web what is cogs? Web cost of goods sold (cogs) is the cost of a product to a distributor, manufacturer or retailer. Web cost of goods sold (cogs) is the carrying value of goods sold during a particular period. Return and allowances are deducted while calculating the cost of goods sold as they are returned to the customers. This template. Web the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. Web cost of goods sold formula. Enter the cost of goods sold by your company. Web download this template and start using it today. Web cogs template you can download below is based on that merchandising companies model. Cogs = (starting inventory + purchases made during the. Web cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. Discover a professional cost of. Web cost of goods sold sheet template posted bydruvisnovember 14, 2019 cost of goods sold is amount paid by. Web cost of goods sold, commonly referred to as cogs, is the sum of costs directly associated with producing the goods sold. Cogs includes all direct costs incurred to create. This easy to use workbook will help you with cogs calculations for the cost of. Cost of goods sold = $51,000; Return and allowances are deducted while calculating the cost of goods sold as they are returned to the customers. Web cost of goods sold: Web download this cost of goods sold (cogs) template design in excel format. This figure includes materials and labor costs,. Web cost of goods sold (cogs) refers to the direct costs associated with producing your product or service. Web packaging also makes goods look appealing for sale and may display a company’s logo or brand. Web the cost of goods (cog) forecast template and spreadsheet include categories for five types of your products and services, with. Web download this template and start using it today. Web download this cost of goods sold (cogs) template design in excel format. Web the cost of goods (cog) forecast template and spreadsheet include categories for five types of your products and services, with. Based on accounting rules and. Web cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. Web cost of goods sold formula. Web packaging also makes goods look appealing for sale and may display a company’s logo or brand. Web cost of goods sold is the total cost a business has paid out of pocket to sell a product or service. Web the basic formula for calculating the cost of goods sold is as follows: Web the cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company. In the income statement for a business one of the key figures is the cost of goods sold (cogs). Return and allowances are deducted while calculating the cost of goods sold as they are returned to the customers. Web cost of goods sold (cogs) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the. Watch on what is included in cost of goods sold? Beginning inventory is the inventory value at the start of an accounting period. Cost of goods sold (or cogs) is the sum of direct expenses.Cost of Goods Sold Statement Templates 13+ Free Printable Xlsx, Docs

Cost of Goods Sold Statement Templates 13+ Free Printable Xlsx, Docs

Cost of Goods Sold Statement Templates 13+ Free Printable Xlsx, Docs

Cost of Goods Sold Example CGS Format Solved Problems

Restaurant Cost of Goods Sold Template in Word, Excel, Numbers, Apple Pages

Cost of Goods Sold Sheet Template Template124

Cost of Goods Sold Spreadsheet Calculate by TimeSavingTemplates

4 Cost Of Goods Sold Templates Excel xlts

Cost of Goods Sold Form Template Sample Templates Sample Templates

Cost of Goods Sold Calculator Excel Templates

Web What Is Cogs?

Web Cost Of Goods Sold Is The Accounting Term Used To Describe The Expenses Incurred To Produce The Goods Or.

Purchases Are The Total Cost Incurred From Manufacturing To Transporting Goods And Services.

Web Cost Of Goods Sold, Commonly Referred To As Cogs, Is The Sum Of Costs Directly Associated With Producing The Goods Sold.

Related Post: